When the Momentum Music Stopped

The market doesn’t just move — it breathes, it forgets, it hesitates. And sometimes, as it did this week, it stumbles in the dark, trying to remember which way the music was playing.

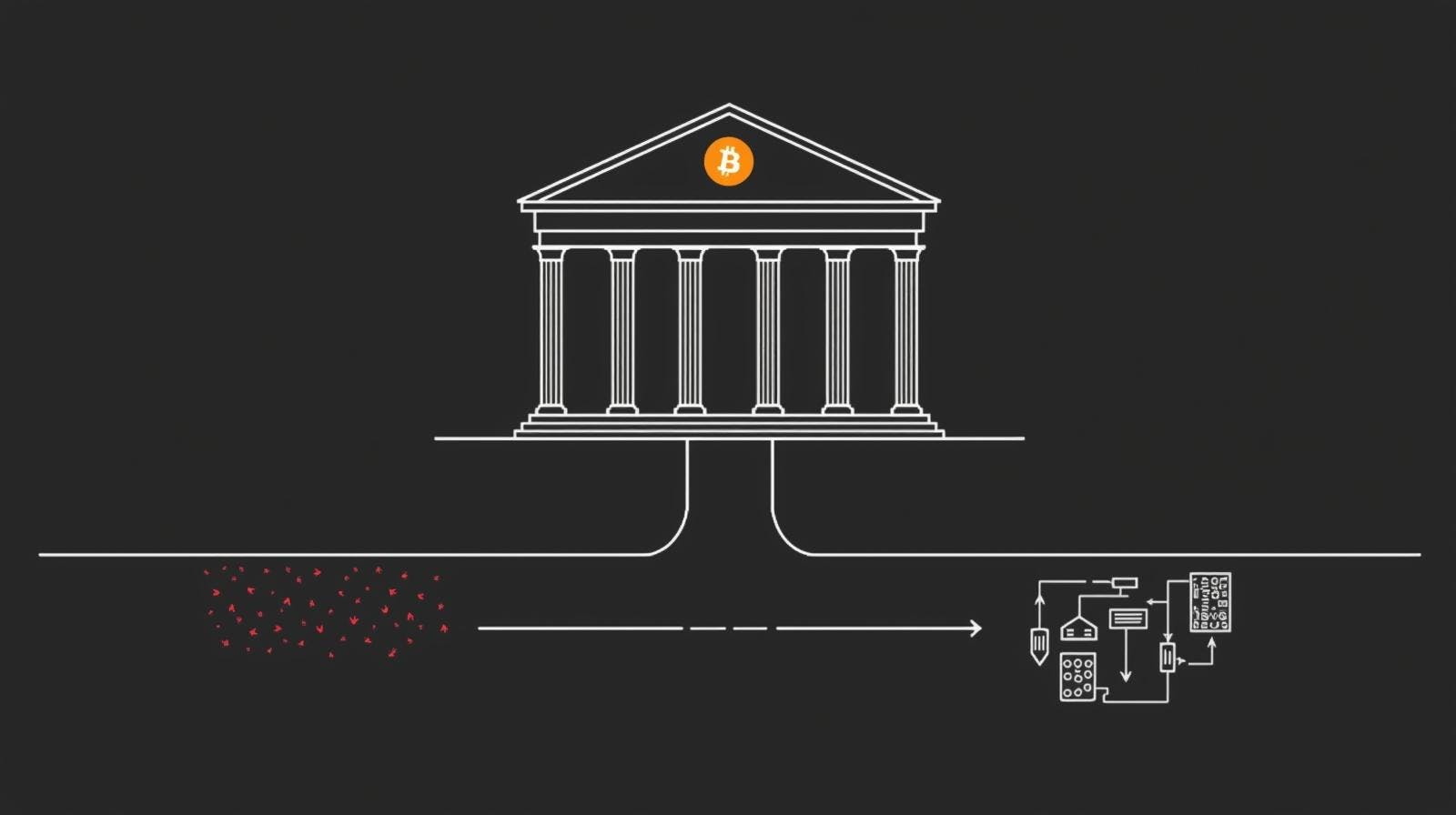

Volatility made a noisy comeback on Wall Street — not with fireworks, but with that unsettling hush that falls when traders realize the rhythm has changed. The once-indomitable Nasdaq lost its footing as Tesla faltered after its third-quarter results, and cryptocurrencies joined gold in the growing lineup of trades that once glittered but now look spent. The same retail favourites that soared like rockets through the summer now resemble Roman Candles fizzling too fast — dazzling for a moment, then gone in a puff.

Markets can stomach bad earnings, inflated valuations, even the odd hawkish echo — but they choke on uncertainty, and this week served it in full measure. News broke that the Trump administration is considering new restrictions on software exports to China, a move that poured fresh kerosene on already smouldering trade anxieties. Each headline now feels like a flicker in the old US-China voltage war, reminding investors that supply chains and silicon are once again policy weapons.

At the same time, an almost absurd irony unfolded: the Federal Reserve, the supposed lighthouse of the financial world, is now sailing without a map. ADP — whose data accounts for nearly a fifth of America’s private-sector payrolls — has pulled the plug on sharing figures with the Fed. Combine that with a government shutdown that’s frozen official releases, and you have policymakers literally navigating by candlelight. The world’s most powerful central bank is now steering the economy by the dim glow of guesswork, intuition, and the occasional speech from a governor who can’t see the dashboard.

It’s hard to overstate the poetry — and danger — of that. The Fed, blindfolded; markets, jittery; traders, once fearless, now feeling for the edge of the table. We’re in that strange interlude when momentum has cracked but conviction hasn’t yet found its next host. It’s not panic, but the absence of clarity — the worst kind of quiet.

Still, even in this dusk, some things glimmer. Corporate America keeps beating expectations. Earnings resilience, AI spending, and seasonal flows suggest that the bull market still has life in it. But until data returns, and policymakers find their bearings, every tick on the screen will feel like candlelight on a stormy sea — visible, yes, but flickering, fragile, and far from certain.

Tesla’s twilight drive

Tesla’s quarter had all the markings of a company running fast but losing traction. Profits fell 37%, even as Americans rushed to buy EVs before the $7,500 tax credit expired — a final sugar high that exposed more profound fatigue. Revenue rose 12%, but the engine beneath it sputtered; record sales, shrinking returns — the math no longer feels exponential, it feels mortal.

Musk’s empire, once fueled by faith and velocity, now runs on friction. His political grandstanding has chilled demand in former strongholds like California and Europe, while Chinese rivals have grown too sharp to ignore. And now comes the power play: Musk wants a $1 trillion pay package and 25% control of Tesla — or he walks. The CEO who built the dream now threatens to take it with him.

Tesla’s cars, meanwhile, are losing their edge. The new stripped-down Model 3 and Y variants cost less but feel hollow — dreams de-contented. Without subsidies, they’re pricier in spirit and in sticker. The recall of 13,000 vehicles for battery issues only deepens the impression of a company struggling to balance between glory and fatigue.

Musk’s gaze has drifted elsewhere — toward robotaxis, humanoid robots, and an AI future that seems just out of reach. But for now, Tesla feels caught between revolutions: no longer the insurgent, not yet the machine it wants to be.

Once, Tesla defied gravity. Now it’s learning how it feels

Trader lens: When the tape turns against you

It started quietly — the kind of quiet that makes old traders shift in their chairs and glance twice at the screen. For months, the market’s rhythm had been too smooth, too forgiving. Gamma hedging, systematic buying, and relentless dip-chasing had turned volatility into a domesticated pet. Every stumble was bought, every scare faded. But this week, the music cracked.

The momentum unwind — once just a tremor under the surface — finally spilled into the open. The “sell the winners” rotation that had begun as profit-taking turned into something darker: a coordinated loss of faith. High-flyers, the same stocks that the year’s liquidity wave had carried, suddenly looked like exhausted athletes — too fast off the blocks, too slow at the turn. Nasdaq stumbled, small caps collapsed, and even the fortress trades — gold, Bitcoin, and AI infrastructure — joined the casualty list.

Under the hood, this wasn’t panic; it was degrossing. Prime books were being cleaned, risk trimmed, leverage pulled. When high-beta momentum breaks down 6% in a few days, it’s not retail emotion — it’s the sound of algorithms dumping exposure, of quant funds switching from risk-on to risk-off in mechanical rhythm. That’s the sound of liquidity leaving the room.

And then came the policy spark. A Trump-era whisper about broad software export curbs to China hit the tape like kerosene. It wasn’t just about geopolitics — it was about the old ghost of trade war anxiety resurfacing right as the market’s technical scaffolding gave way. In a market addicted to predictability, even a hint of new uncertainty felt radioactive.

Meanwhile, the once-reassuring ballast of gamma hedging flipped sides. For months, options dealers had been a stabilizing force — selling volatility, buying dips, suppressing swings. But with negative gamma now dominating, that mechanic reversed. Dealers started selling into weakness and buying into strength — amplifying every move. The same invisible hand that cushioned the fall all year is now kicking the legs out from under the table. It’s a mechanical irony straight from Minsky’s playbook: stability breeds the conditions for instability.

And that’s where we are — not in chaos, but in transition. Momentum’s meltdown is the canary, not the collapse. Every cycle needs a reckoning, and this one is unfolding in textbook fashion. The options market, swollen by 0DTE strategies and passive income funds writing calls for yield, has become the great suppressor of realized volatility — until now. With gamma turning negative, all that calm surface energy has inverted into something combustible. Traders who’ve forgotten what real volatility feels like are about to be reacquainted with it.

The cracks are everywhere if you know where to look: profitable tech bleeding, unprofitable tech finally losing its sugar rush, quantum computing darlings unraveling like they were priced for a different dimension. Retail volumes are exploding again — the kind of manic energy that always shows up at the end of the dance. Meme stocks flare and fade within hours. It’s all there: the last euphoric gasp before discipline returns.

What’s most striking isn’t the speed of the decline, but how normal it feels. That’s how regime changes begin — not with a crash, but with a slow-motion realization that the old rules no longer apply. Market-makers aren’t the buffer anymore. Hedging doesn’t cushion. Liquidity isn’t reflexive. And for the first time in months, traders can feel gravity again.

You can sense the fatigue across every asset class. Gold failed to hold its bounce, silver’s strength looks brittle, and Bitcoin has been trading like an overleveraged tech proxy, not digital gold. Even the AI dream — those high-voltage data center plays that powered the summer narrative — now looks like it’s running on fumes. CapEx fatigue, guidance cuts, and valuation déjà vu are replacing the once euphoric “infinite demand” stories.

And yet — as always — beneath the panic there’s method. The market isn’t dying; it’s rebalancing. Excess is being wrung out the way it always is: painfully, chaotically, and just as everyone was getting comfortable. The only thing unusual about this correction is how overdue it was.

Negative gamma has become the market’s new gravity, pulling everything back to earth. And if history is any guide, the longer volatility was suppressed, the more violent the release. This is not the end of the bull — it’s the cleansing storm before it can begin again. But as every trader learns sooner or later: when the music stops, you don’t look for the next song — you make sure you still have a chair.