How To Stake Digital Assets On MEXC Exchange

Note: You can start staking digital assets on MEXC without KYC verification. Daily withdrawal limit is set to 10 BTC/day for non-KYC users.

Staking on MEXC is a simple way to earn passive crypto by locking up your coins on the exchange. In other words, you hold crypto in your account and MEXC pays you interest (usually daily) for helping secure networks or participating in projects.

MEXC’s staking features – especially the MEXC Earn platform and a new liquid SOL Staking product – make it pretty easy to grow your crypto over time. In this guide, I’ll walk you through what staking on MEXC means, how it works, step-by-step instructions for staking, safety tips, and even how it stacks up against Kraken’s staking.

What is MEXC Staking?

MEXC staking lets you earn rewards from your crypto without doing active trading. Basically, instead of keeping coins idle in your wallet, you “stake” them on MEXC, and the exchange pays you interest.

MEXC Staking includes things like Flexible Savings, Fixed Savings, and on-chain Earn products – all part of the MEXC Earn platform. You can use this to earn a little extra on cryptocurrencies you already own, such as Polkadot, Ethereum, USDT, SOL, and many others.

In a nutshell, when you are staking digital assets on MEXC, you give the platform permission to lock up your coins for a certain time, and in return, you get paid (usually daily) based on an Annual Percentage Yield (APY).

The APY varies by coin and by whether you choose a flexible (withdraw anytime) or locked plan. One cool thing is that MEXC also offers liquid staking for Solana (SOL) – you stake SOL but get a new token called MXSOL that you can still trade. This means your funds stay liquid even while they earn rewards. (Read my honest MEXC global review)

Is Staking Digital Assets on MEXC Safe?

Honestly, staking digital assets on MEXC is considered pretty safe from a technical perspective, but it’s not without risks. The platform uses solid security measures: two-factor authentication (2FA), cold storage for most funds, anti-phishing codes, and strict encryption.

In other words, MEXC follows the usual best practices to protect your crypto, just like bigger crypto exchanges do, like Binance or Coinbase. They even have a big Guardian Fund (like $100 million) that covers user losses in case of hacks or big problems. So the tech side is mostly covered.

That said, MEXC is an offshore exchange (based in Seychelles) and isn’t regulated in the US or major markets. This means it’s not under a strict US or EU regulator, unlike Kraken or Coinbase. In practice, it has served 40M+ users worldwide without major breaches, but you do have to trust the exchange with custody of your coins.

A few users have reported MEXC temporarily freezing accounts if they see unusual activity – this is their “risk control” in action. So just be aware: unlike staking with a hardware wallet or fully decentralized platform, staking on MEXC means trusting the company.

Types of Crypto Staking on MEXC

MEXC offers a few different ways to stake your crypto. The two main ones are MEXC Earn (Savings) products and SOL Staking (MXSOL). Here’s how they work:

MEXC Earn (Savings)

This is a general savings program. There are flexible savings (you can deposit or withdraw anytime) and fixed savings (you lock your coins for a set period, like 7, 15, 30 days, etc.).

Flexible savings usually have lower APYs (single digits or teens), while fixed savings lock your coins for a week or more and pay higher APYs. You can stake common coins like USDT, USDC, BTC, ETH, ADA, and more. The APY changes based on demand and available supply.

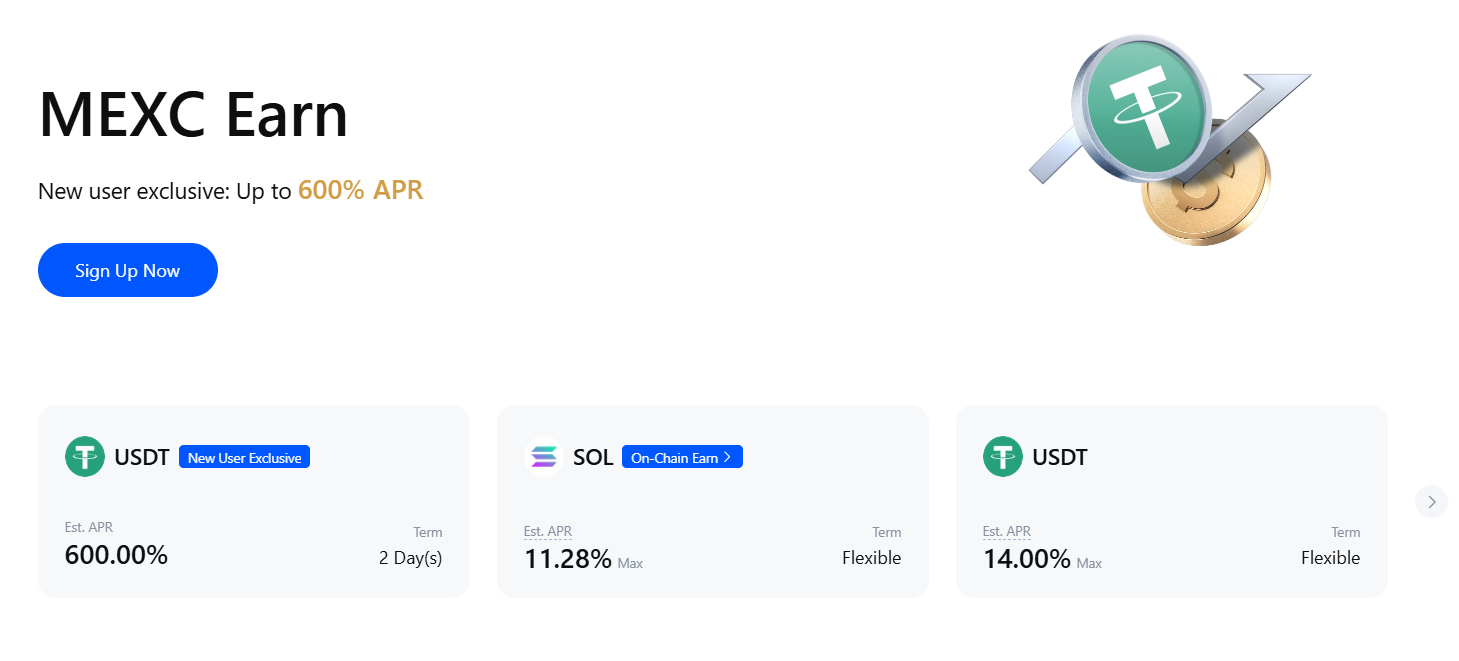

Sometimes MEXC even runs promotions with huge APYs (for example, in a recent campaign, they advertised up to 600% APY on USDT staking for a limited time for new users only). In normal times, stablecoins like USDT or USDC might give 2-6% APY flexibly, while small coins could offer 10-20% on fixed terms.

Solana (SOL) Staking: Liquid Staking

Starting in June 2025, MEXC added a special liquid staking product for Solana. When you stake SOL here, you get an equal amount of a new token called MXSOL in your spot wallet. MXSOL is essentially a “receipt” token that represents your staked SOL plus rewards. The best part is that MXSOL is tradeable, so your funds stay liquid. MEXC advertises that staking SOL this way can earn up to about 8% APY (based on Solana’s network rewards).

You hold MXSOL, and its value relative to SOL grows as staking rewards accumulate. When you redeem, you swap MXSOL back to SOL and get both your original SOL and all earned interest.

This product has no lock-up – you can redeem anytime, although it may take a few days for the transaction. Liquid staking is great if you want SOL exposure and rewards, but still want the option to trade or sell immediately.

Staking Digital Assets on MEXC: Step-by-Step Guide

Now let me show you exactly how you would stake on MEXC. It’s pretty straightforward. Here are the basic steps:

Step 1: Sign up / Log in and Verify

First, create a MEXC account if you don’t have one. You can sign up with your email or phone. MEXC lets you trade and stake without full KYC, but your withdrawal limits are lower until you do KYC. To be exact, your daily withdrawal limits will be 10 BTC per day, that fair I think.

Note: New users can use my MEXC referral code “mexc-1b9QM” to get a $10,000 sign-up bonus.

For staking, you typically just need Basic KYC (name and email verified). But again, I recommend verifying your identity to remove limits and qualify for all products. After signing up, secure your account with a strong password and enable 2FA (Google Authenticator is great) and an anti-phishing code if you can.

Read: Best no-KYC crypto exchanges

Step 2: Deposit Crypto

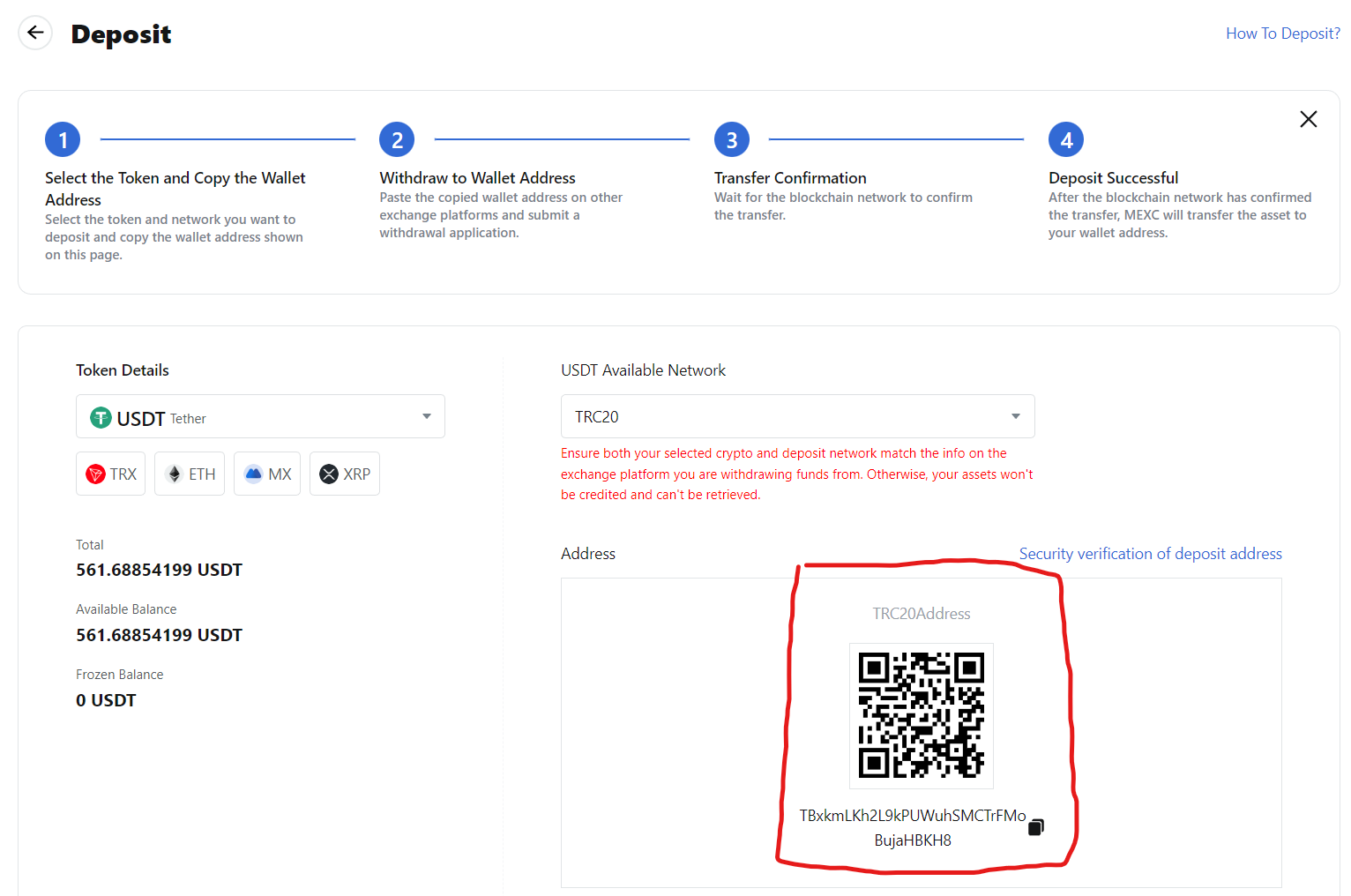

Next, you need coins in your MEXC account. If you already have crypto, you can deposit it from another wallet or exchange into your MEXC spot wallet.

Just go to Assets > Deposit, pick your coin (like USDT or SOL), and copy the deposit address or scan the QR code. If you don’t have crypto yet, you can also buy some on MEXC with a card or via P2P.

The key is: make sure the coin you deposit matches the coin you want to stake.

Step 3: Navigate to MEXC Staking Products

Once you have the coin in your spot wallet, go to the “Earn” section. On the web, you might see a top menu with“Earn” or even directly “Savings” and “SOL Staking”.

On the mobile app, look for “Earn”. Here you’ll find “Flexible Savings”, “Fixed Savings”, and a special “SOL Staking” page. For example, to stake SOL, click on the SOL Staking or MXSOL area. To stake other coins, go into Flexible or Fixed Savings.

Step 4: Select Digital Asset for Staking and Amount

Choose the coin you want to stake. For savings, you’ll see a list of coins with their current APY. Pick one (say USDT). Enter the amount you want to stake. You can typically stake any amount up to your balance.

For fixed savings, select a term (like 14 days), and it will show you the estimated APR or APY. For SOL Staking, just enter how much SOL to stake (the system will show how much MXSOL you’ll get). Double-check the numbers – for fixed staking, there may be a minimum or limit if it’s a promo.

Step 5: Confirm and Stake

Read the details (lockup period, rewards, etc.), then confirm the stake. For fixed plans, you may see the exact interest you’ll earn. Click Confirm or Subscribe.

After you do this, the crypto moves out of your spot wallet into the staking program (you might see it in a “Locked” or “Staking” balance). From now on, your interest will start accruing automatically. MEXC usually credits your earnings daily or at the end of each epoch (for SOL).

Step 6: Monitor and Redeem

You can check your staked balance in the Earn or Wallet page. The interest keeps adding up. When you’re ready, if it’s a flexible savings or SOL staking, you can click Redeem anytime to unlock your coins.

Fixed savings usually let you redeem at term end (or early with a penalty). For SOL/MXSOL, redeeming swaps your MXSOL back to SOL over a few days (as described in the SOL staking info).

MEXC Staking vs. Kraken Staking: Which is Better?

I know you might be wondering how MEXC compares to other big names like Kraken, which is also popular for staking. Here’s a quick breakdown in plain terms:

- Regulation & Trust: Kraken is fully regulated in the US and many countries. It’s an older exchange with a very strong reputation for security. MEXC is not US-regulated and is based offshore. For maximum peace of mind, Kraken wins, but MEXC is still trusted by millions worldwide.

- Supported Assets: Kraken supports staking for many major coins (over 15, including ETH, SOL, DOT, ADA, etc.) with known rates. MEXC also has dozens of cryptocurrencies available in its Earn platform (including major and many smaller altcoins). MEXC might have more variety for big promotions or trendy tokens (Kraken sticks to the well-established ones only).

- Staking Yields: This is a big one. MEXC is famous for high promotional APYs. You might see “up to 600%” on tiny tokens during events or high single digits on stablecoins normally. Kraken’s APYs are more modest – think single digits or low double digits for most digital assets. For example, Kraken might offer 4-10% on something like DOT, whereas MEXC could have 10-20% on an altcoin in a special savings plan.

- Fees & Commissions: Kraken charges about a 15% commission on staking rewards (the validator’s fee). MEXC’s savings programs don’t take a commission from your rewards in a noticeable way; the APY shown is what you get. So in terms of net yield, MEXC can feel more direct.

- Ease of Use: Both have user-friendly interfaces. One thing: Kraken forces you through full KYC right away (since it’s in regulated markets). MEXC lets you trade/stake a bit before KYC, which can feel easier if you want to start quickly. However, if you skip KYC, MEXC will limit withdrawals and some rewards.

- Flexibility: MEXC’s flexible savings and liquid staking mean you can often withdraw anytime (though usually with short processing time). Kraken has “flexible” and “locked” too, but the terms can be longer (and the coins you withdraw might have a brief unbonding period on-chain).

If you absolutely need regulation and rock-solid trust, Kraken is a great choice (they even have a Kraken staking on/off ramp, and your deposits are insured in Europe).

But if you want higher yields on a bunch of coins and you don’t mind the extra risk, MEXC offers more opportunities (especially if you like promotions and new tokens). For many beginners in crypto, MEXC might feel more exciting and hands-on, while Kraken is a safer, slower, but steadier approach.

Personally, I’d say Kraken is safer, but MEXC is better for high yields and variety.

Read my Full Kraken exchange review

Safety Tips Before You Stake on the MEXC Platform

Look, staking can be great, but only if you do it smartly. Here are a few tips to keep things safe and smooth:

- Secure Your Account: Always use a strong, unique password and turn on 2FA (two-factor authentication). MEXC supports Google Authenticator or other 2FA apps. Also, set an anti-phishing code and email lock if they have it. These small steps can prevent someone from hacking your account.

- Verify Identity (KYC): Even if you don’t plan to withdraw a ton right away, I recommend finishing at least basic KYC. It increases your withdrawal limit and shows you’re a real user. Plus, some bonuses or promotions require KYC. It can also protect you from impersonators – if MEXC sees your real info, they’re less likely to accidentally flag your own trading as “suspicious”.

- Stake What You Can Afford: Don’t put all your crypto into staking. Keep some in a personal wallet. Remember, when coins are staked or in savings, they’re locked. Only stake what you don’t need in the near future. And never stake money you absolutely can’t live without, just in case (though MEXC has never had a major hack, crypto always has some risk).

- Check Terms and APY: Before clicking “stake,” double-check how long it’s locked and what happens if you withdraw early. Some fixed plans give lower interest if you break them. Also, verify the APY on the official MEXC page – rates can change with demand. Don’t trust rates quoted in random chat groups. Always check on MEXC’s site or app.

- Beware Phishing and Scams: Only log in at the real MEXC website (make sure it’s https and the correct domain). Don’t click suspicious links even if they promise high rewards. MEXC staff will never DM you asking for your password. If you get an email or social message saying “urgent action” or something, be skeptical.

- Start Small: If you’re new, try a small test stake first. See how the interface works and how rewards show up in your account. This way, you’ll get comfortable before moving larger amounts.

- Diversify: Like any investing, don’t put everything into one staking product. Spread your crypto across a couple of assets. For example, you might stake some stablecoins (for low-risk APY), some ETH (as it’s big), and maybe a bit in SOL staking or a trendy coin. This way, if one coin dips, not all your “passive income” dries up.

Different Ways to Earn Passive Income on MEXC Global Exchange

Futures Earn

This is a feature where any funds you hold in your Futures wallet automatically start earning interest. For example, if you keep USDT or USDC in your futures account (even if not actively trading), you can get up to ~15% APR on those balances.

It’s really convenient: just transfer some stablecoins to your futures wallet, and MEXC pays interest daily without affecting your trading. It’s called “Futures Earn” and is great if you already use the futures section.

Launchpool Events

MEXC regularly runs Launchpool campaigns where you stake tokens (often the MX native token or stablecoins) for a chance to earn new tokens.

For example, a new crypto project might partner with MEXC, and users can stake MX or USDT to get that project’s token. The rewards are distributed according to your stake. It’s a way to get free tokens from emerging projects.

Keep an eye on the Launchpool page – at any time, there might be a few active pools with juicy APRs (sometimes very high for MX stakes).

Rewards Hub

MEXC has a Rewards Hub (or similarly named feature) where you complete simple tasks to earn bonuses. This is especially for new users.

Tasks might include: verifying your identity, making your first deposit, trading a bit, following MEXC on social media, etc. Each task gives you vouchers or small crypto rewards (like USDT).

For example, new users can earn a total bonus of up to $1000 in crypto by ticking off all the basic tasks. It’s basically free crypto for doing easy steps.

Referral Program

If you have friends interested in crypto, you can invite them to MEXC with your referral code. When they sign up and trade, you get a commission – up to 40% of their trading fees.

So every time your friend trades spot or futures, you earn a bit of that fee. The more active friends you invite, the more you earn. It’s passive in the sense that once they’re on board, you just collect commission.

MEXC often has referral events, too (like bonus rewards for referring a certain number of users). It’s a popular way to boost passive income if you know people into crypto.

Conclusion: Staking Cryptocurrency on MEXC

Honestly, staking digital assets on MEXC is a friendly way to make your crypto work for you. You can earn a bit extra on coins you’d hold anyway. By following the steps above, you’ll be up and running – putting coins into MEXC Earn or SOL staking and watching rewards roll in.

It’s not all rainbows, though: MEXC’s big draws are high yields and easy access to new projects, but that comes with more risk than a fully regulated exchange. So use common sense: start small, enable security features, and only stake what you’re comfortable with.

As a beginner, I’d say try it out – maybe stake some stablecoin in a flexible savings plan, and maybe a small amount of SOL to see the liquid staking in action. Keep your eyes peeled for the APYs and promotions (MEXC often offers crazy campaigns, like 600% APR on USDT recently, but those are temporary events). And of course, compare with places like Kraken if you feel better having that extra peace of mind.