Trump Considers Pro-Crypto Michael Selig As New CFTC Chair

Join Our Telegram channel to stay up to date on breaking news coverage

US President Donald Trump is set to nominate pro-crypto Michael Selig as the next chair of the Commodity Futures Trading Commission (CFTC).

That’s according to a Bloomberg report that cited an unnamed Trump administration official.

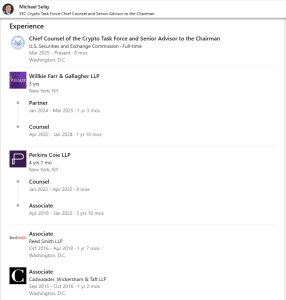

Selig is currently chief counsel at the Securities and Exchange Commission’s (SEC) crypto task force and also a senior adviser to SEC Chair Paul Atkins. Some analysts and influencers in the crypto community have characterized him as crypto friendly.

”@MikeSeligEsq is prepared to lead @CFTC from day one with a strong understanding of crypto’s potential to position the U.S. as a financial leader for generations,” The Digital Chamber said in a post on X.

We confidently support the nomination of Michael Selig as CFTC Chair. This is a critical era for crypto policy and @MikeSeligEsq is prepared to lead @CFTC from day one with a strong understanding of crypto’s potential to position the U.S. as a financial leader for generations. pic.twitter.com/1AWbBRi6oc

— The Digital Chamber (@DigitalChamber) October 24, 2025

Selig is not the first pro-crypto person that Trump has nominated for key roles under his administration. At the start of his second term, he appointed David Sacks, who is a former PayPal executive and prominent crypto-industry investor, as the White House’s AI and Crypto Czar.

A few months later, Trump nominated Atkins, who is known for more industry-friendly positions on crypto, as the Chair of the SEC. His nomination received full Senate confirmation on April 9, and was sworn in as the agency’s Chair on April 21.

The report that Trump is considering Selig to lead the CFTC comes after the nomination of Brian Quintenz stalled in September after pressure from Gemini co-founders Cameron and Tyler Winklevoss led to Trump withdrawing his nomination.

Selig’s work experience (Source: Linkedin)

CFTC And SEC Collaborate To Realize Trump’s Crypto Capital Goal

While campaigning to be president, Trump promised to make the US the crypto capital of the world and said he would be a “crypto President.”

He wasted no time delivering on the vow. Shortly after his inauguration in January, he established a working group on digital asset markets and signed an executive order to establish a US Strategic Bitcoin Reserve and a US Digital Asset Stockpile.

In September, the SEC and CFTC started collaborating on crypto policy, with the goal to create a regulatory framework that both protects investors and allows for innovation.

The agencies issued a joint statement announcing a formal initiative to harmonize their regulatory frameworks for digital assets. In this statement, the agencies also outlined potential areas of coordination such as aligning product definitions, reporting and data standards, and possibly establishing coordinated innovation exemptions under each agency’s authority.

It’s a new day. Onwards 🇺🇸🫡 #ProjectCrypto @SECPaulSAtkins @SECGov @CFTC @A1Policy pic.twitter.com/kChRm036Mg

— Caroline D. Pham (@CarolineDPham) July 31, 2025

Both the CFTC and SEC have also acted on recommendations from the White House’s digital assets working group on how to regulate crypto.

The group classified most cryptocurrencies as commodities and recommended that the CFTC should have oversight over the spot crypto markets. Trump himself has mulled handing oversight of the crypto market to the CFTC.

Acting on the working group’s recommendations, SEC Chair Atkins announced “Project Crypto,” which seeks to ease licensing requirements for crypto firms, among other things.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage