TAO to $5K? Bittensor’s Chart Mirrors Bitcoin’s Pre-Halving Path

Bittensor’s first halving lands in December 2025, when daily emissions drop from 7,200 TAO to 3,600 TAO. The mechanism echoes Bitcoin’s scarcity model, but with a twist: Bittensor’s token incentives are aimed at the AI compute and model marketplace, not just monetary settlement. If the network keeps attracting miners (validators) and demand for on-chain AI services grows, the emission cut could matter – both for tokenomics and sentiment.

Right now TAO trades around ~$380, well below its ~$760 all-time high. For would-be entrants, that gap is meaningful: if the broader market heats up in November and “pre-halving” positioning begins, a revisit of the upper range is plausible before December’s supply change.

The Thesis Making the Rounds: Bongo’s “Bitcoin 2012” Analogy

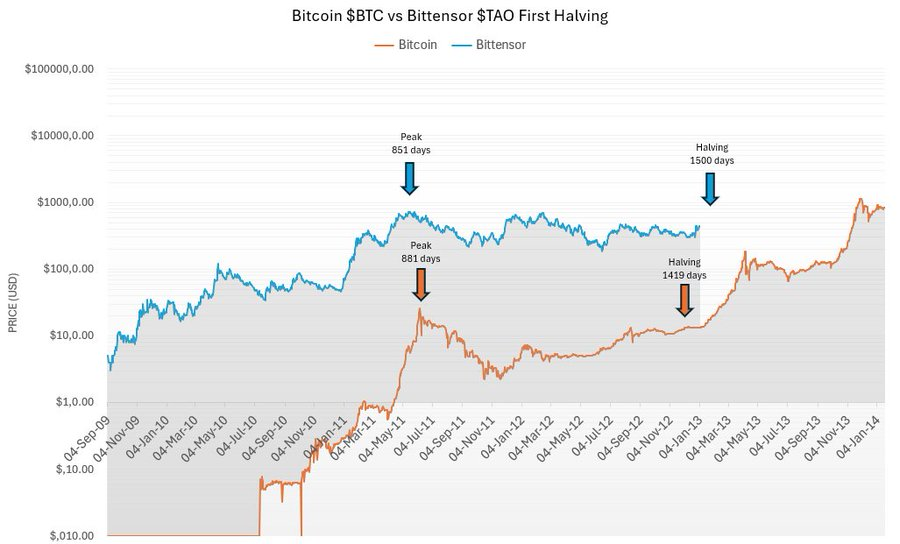

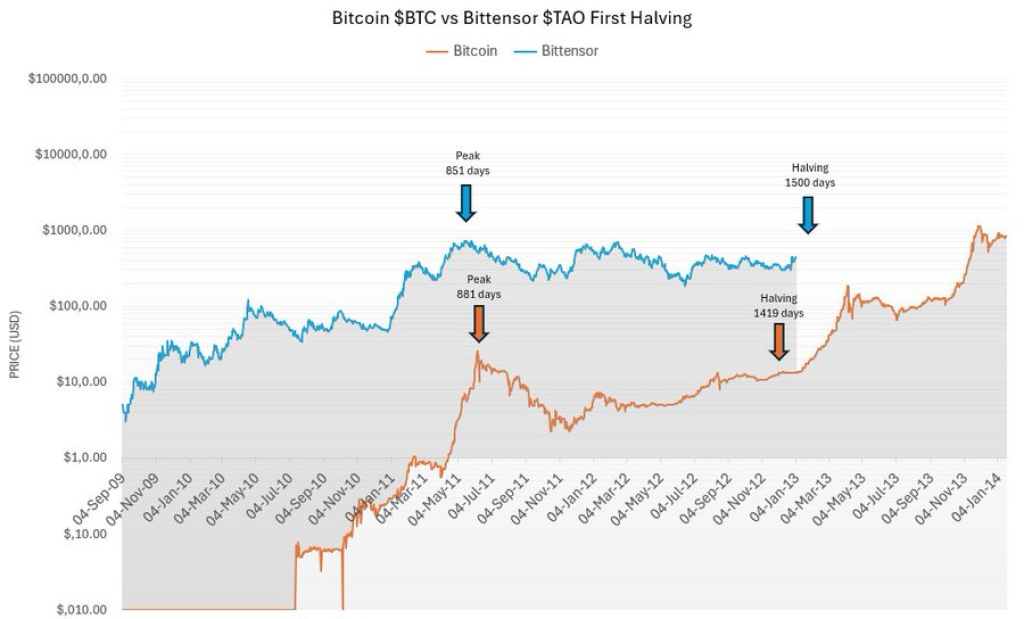

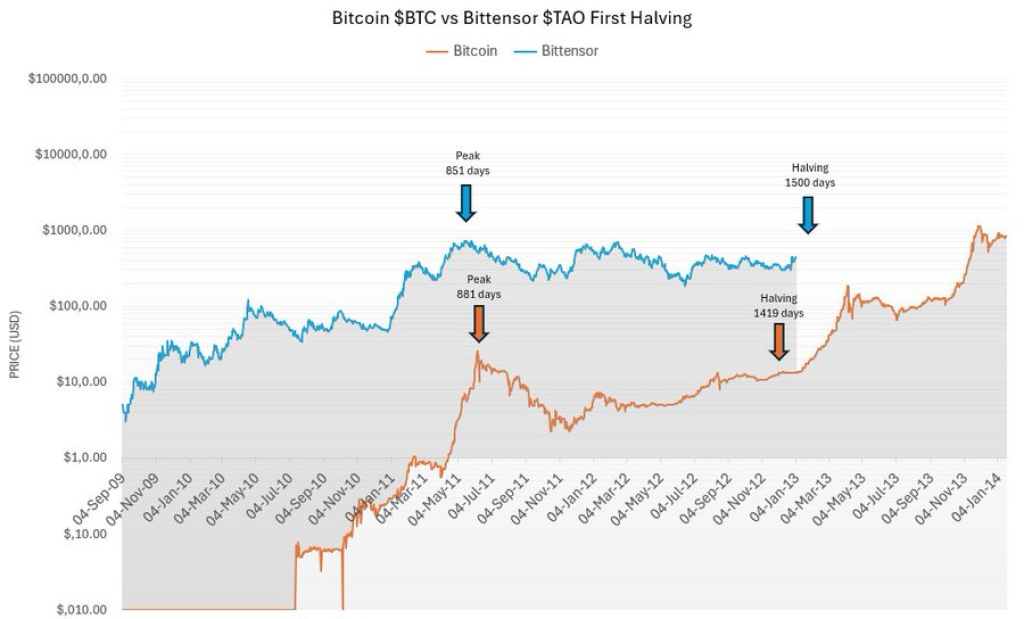

Crypto trader Bongo argues that Bittensor’s price structure is closely tracking Bitcoin’s first halving cycle. In his overlay, early TAO price action lines up with Bitcoin’s 2010–2012 path: a rapid markup, a sharp comedown, sideways consolidation, and then an expansion phase that followed the halving.

What Bongo’s chart highlights

- Matching timeframes: The spacing between the local peaks and the upcoming halving resembles Bitcoin’s early cadence.

- Similar peak-and-bleed behavior: Both assets show a blow-off, retrace, and then a long pre-halving base.

- Pre-halving drift, post-halving thrust: In Bitcoin’s first cycle, the halving marked the transition from choppy consolidation to a trend expansion. Bongo suggests TAO could rhyme with that.

His punchline: “If it holds… a 10x post-halving #1 would see TAO around $5,000 by mid-2026.”

It’s an ambitious target, but the logic is simple: if TAO continues to mirror Bitcoin’s earliest halving rhythm and demand materially increases while issuance halves, the asymmetric upside can compound quickly.

Right now, TAO’s structure still looks constructive. The $350–$370 zone has acted as a strong pivot area, holding as support during recent volatility. If bulls manage to push TAO above the $450–$500 range, that could signal a meaningful momentum shift. Above that, the $600–$650 range becomes the next key zone before a potential retest of the $760 all-time high.

If the market begins to price in the upcoming halving as early as November, the TAO price could see a pre-halving run similar to Bitcoin’s famous “front-run rallies.” Historically, halving narratives alone have been powerful enough to attract speculative capital, even before any fundamental supply changes take effect.

Why the Bitcoin Analogy Works

Bittensor’s supply dynamics and its growing role in the AI economy make the Bitcoin comparison particularly compelling. Like Bitcoin, it’s a decentralized network with a capped emission schedule, but instead of serving as “digital gold,” TAO powers a global marketplace for machine learning models. The halving will slow the issuance of new TAO, making it scarcer over time while maintaining demand through validator incentives and AI task rewards.

The psychological effect of a halving event shouldn’t be underestimated either. Crypto traders remember what Bitcoin’s early halvings did for its price, and that narrative can create a feedback loop of buying pressure. However, there are also important distinctions – Bittensor’s market depends on AI adoption, data usage, and computational demand, which means its growth trajectory will depend heavily on real-world adoption, not just speculation.

TAO’s Path to $5,000

For Bongo’s $5,000 target to become reality, Bittensor would need more than just hype – it would require widespread adoption and significant demand for decentralized AI infrastructure. That means more developers building subnets, enterprises using Bittensor’s framework for machine learning, and consistent on-chain activity translating into real economic value.

Macro conditions will also play a big role. If 2026 sees a healthy crypto cycle instead of another bear market, TAO’s scarcity and utility narrative could align perfectly with a broader risk-on environment. A move from $380 to $5,000 would represent a 13x rally, which is ambitious but not impossible in crypto terms – especially for a token that sits at the intersection of two of the market’s strongest narratives: AI and decentralization.

Read also: Top Analyst Predicts Massive Year-End Rally: Bittensor (TAO) and These Altcoins to Soar

TAO Price Outlook Ahead of December

In the short term, traders are watching the $450–$500 level closely as the key resistance zone to break. If momentum accelerates into November, TAO could easily revisit the upper range near its all-time high before the halving even occurs. A pre-halving rally followed by a consolidation phase and then a post-halving breakout would fit perfectly within Bitcoin’s historical pattern.

As always, nothing in crypto follows an exact script, but history often rhymes – and that’s the essence of Bongo’s analysis. The December halving is a clear catalyst, and with AI narratives showing no sign of slowing down, Bittensor may find itself at the center of 2026’s next big cycle.

If the project can sustain real demand while cutting its emissions in half, TAO might not just rhyme with Bitcoin – it could start writing its own verse in crypto’s next bull market story.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.