SUI, LINK, and LTC Are All Crashing; Here’s Why All Eyes Are on Digitap ($TAP)

The crypto market recently experienced its most turbulent week in 2025. On October 11, altcoins that had been showing signs of steady recovery suddenly faced severe declines, with some plunging nearly 95%. It left traders reeling as over $19 billion worth of positions were liquidated across major exchanges.

The market might be on its way to recovery with prices recovering in Monday trade. Amid the market chaos, one name stood out: Digitap ($TAP). While well-known tokens struggled, Digitap’s Stage 2 presale moved closer to completion, drawing strong interest from investors looking for stability and real-world use in a volatile market.

SUI TVL Drops to $2.06 Billion as Investor Confidence Weakens

SUI was among the most volatile performers of the week. The token dropped dramatically from $3.71 to $0.56 in one of the biggest intraday moves the year has witnessed. It has, however, bounced back to about $2.85 but is still down 20% on the weekly chart.

SUI Weekly Price Chart | Source: CoinMarketcap

The on-chain data by DefiLlama reveals weakening investor sentiment. SUI’s total value locked declined to $2.06 billion, which indicated capital outflows. Weekly decentralized exchange volumes did rise by 62% to $7.92 billion, implying panic selling and not healthy accumulation.

Sui – Total Value Locked | Source: DefiLlama

Market observers pointed out that such dramatic volatility is normally the aftermath of extended periods of over-leverage in the market. Some traders believe that big players purposely drained liquidity to push weaker hands to the exit.

SUI is currently struggling with strong resistance between $2.81 and $3.47, and breaking above the range may mark the beginning of a rebound.

SUI Price Chart Analysis | Source: @degensing on X

For now, sentiment is unstable as traders closely observe to find out if the token will be able to remain above the important support point of $2.43.

LINK Faced $183.9 Million in Liquidations During Market Crash

Chainlink also got into the trend of falling altcoins. Having dropped 65% to a two-year low of $7.90, LINK recovered but is still down close to 13% on the weekly charts, trading at around $19.46. Its market cap is now at $13.25 billion with 24-hour trade volume over $1.3 billion.

Chainlink (LINK) Weekly Price Chart | Source: CoinMarketcap

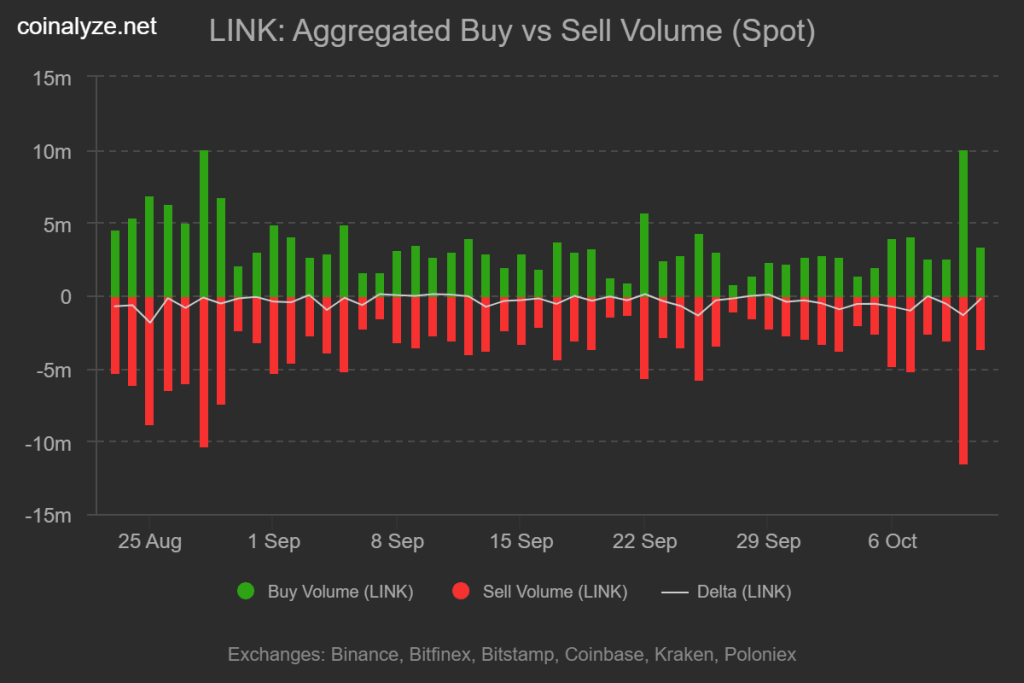

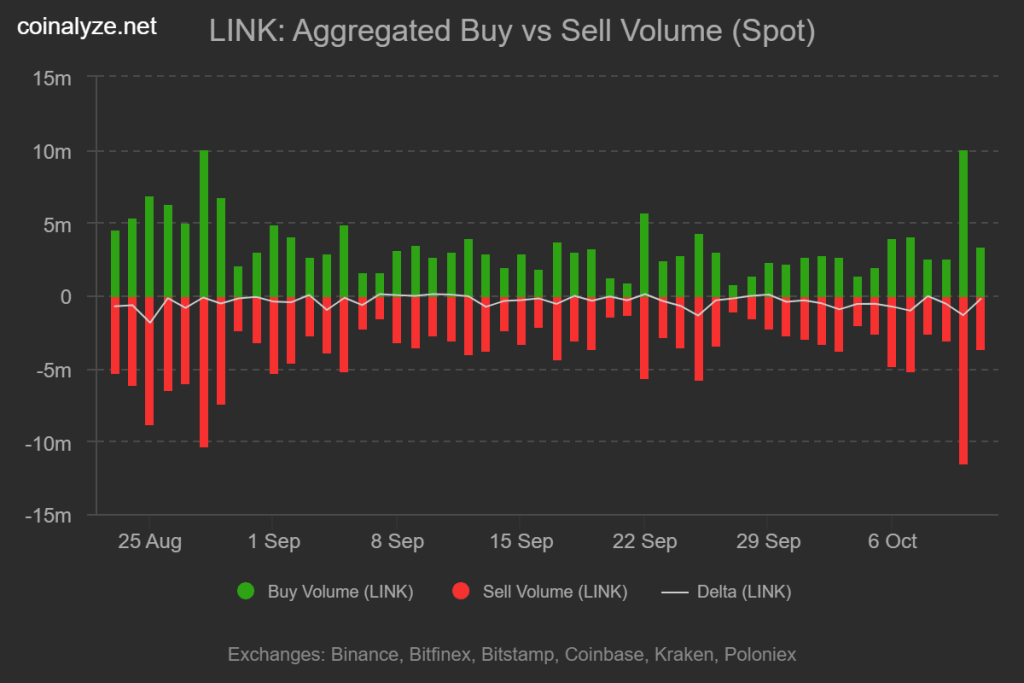

As per Coinalyze, on the day of the crash, Chainlink had higher sell volume than buy volume, at 11.46 million versus 10.1 million, showing forceful selling in spot markets.

Chainlink’s Aggravated Buy vs Sell Volume (Spot) | Source: Coinanalyze

Futures data on Coinglass revealed a major increase in liquidations on October 10, with long positions of $167.34 million and short positions of $15.4 million. The sell-off extended to October 11, with the addition of another $1.2 million.

A total of around $184 million worth of futures positions were liquidated within 24 hours. The figure is indicative of an over-leveraged derivatives market in which optimism was replaced by panic within hours.

LINK Total Liquidation Chart | Source: Coinglass

While short-term devastation is expected, some traders anticipate stabilization once excess leverage is purged and network fundamentals regain investor confidence.

Litecoin Holds Ground After a Sharp Price Drop

LTC followed the broader market plunge, dropping from $134.40 to $84.79 before recovering slightly to $97.37. Weekly losses sit at around 19% for LTC.

Litecoin (LTC) Weekly Price Chart | Source: CoinMarketcap

However, data from Coinglass indicated $10.58 million of outflows from exchanges on that day, a sign that long-term holders are more likely to be building up rather than selling.

Litecoin Spot Inflow/Outflow Chart | Source: Coinglass

Market analysts point out that Litecoin has consistently found support near the $80 level during past corrections. In spite of a bearish sentiment, the fundamentals of the asset remain strong. Increased long positions indicate that investors are hedging for a rebound in the event of decreasing market volatility.

Earlier forecasts placed resistance around the $132–$135 zone, a level LTC struggled to break before the downturn. If bearish pressure continues, $50 retest is possible, as per estimates from the market analyst Ali. Although this point is an extreme scenario.

Litecoin (LTC) Price Chart Analysis | Source: @ali_charts on X

Digitap Emerges as a Safe Haven Amid a Major Market Crash

While top altcoins such as SUI, Chainlink, and Litecoin are struggling with deep corrections and weakening momentum, market attention is turning towards Digitap. The platform is gaining attention for its stability and innovation in a volatile market.

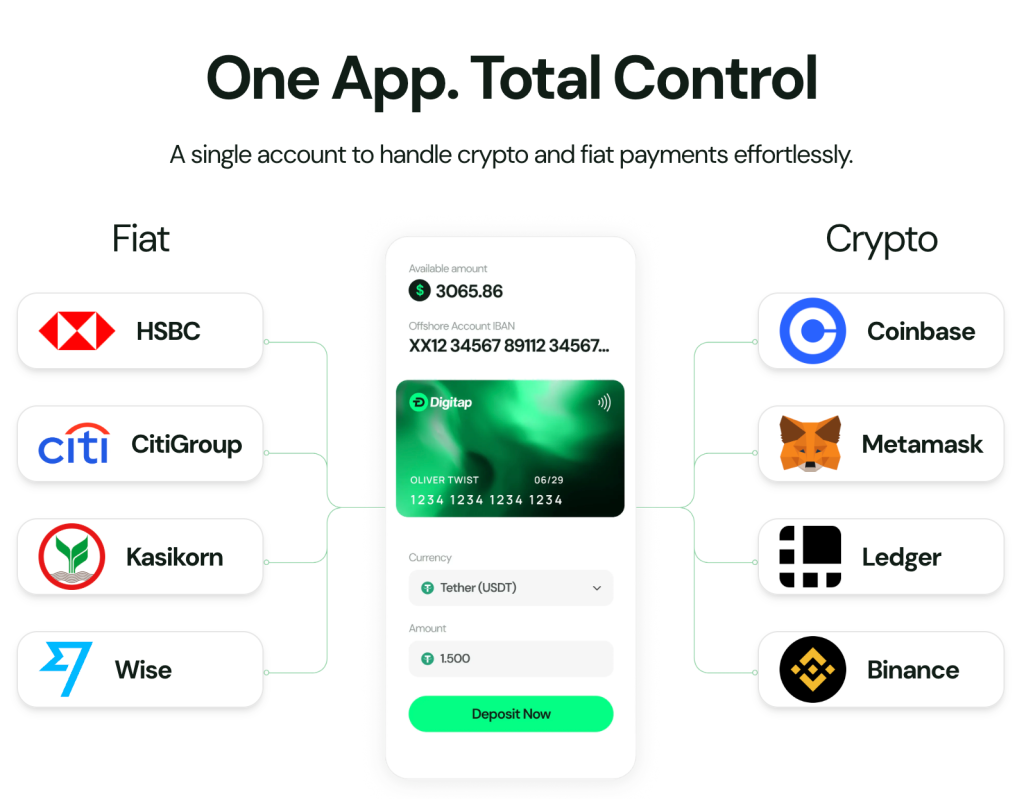

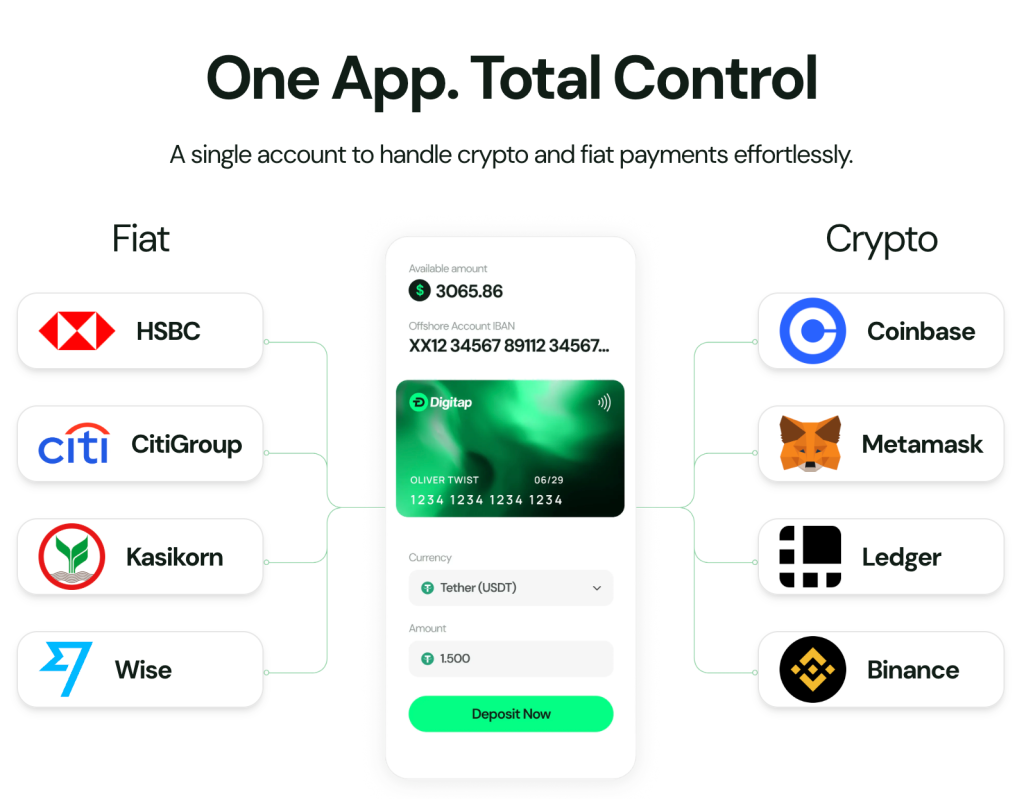

In contrast to these other older networks that focus so much on speculative trading, Digitap arrived on the scene with an operational product already underway. It’s the world’s first omni-bank, and it enables users to hold crypto and fiat assets simultaneously in a single secure app.

The platform combines on-chain settlement with off-chain banking infrastructure such as SWIFT and SEPA, allowing for instant cross-asset transfers.

Its AI-based routing network ensures transactions. It includes crypto swaps or fiat exchanges, taking the most cost-effective route, minimizing spreads and settlement times. Digitap’s focus on compliance, privacy, and real-time proof-of-reserves also positions it ahead in the market.

The project’s lure also stems from having a live mobile app on both Google Play and the App Store. Anyone who’s interested can save, and spend with ease. This functional framework differentiates it from other presale coins that are yet to reach adoption milestones.

$TAP Presale Raises $700K With Stage 2 Almost Sold Out

Digitap’s presale has seen consistent inflows even in a market crash, indicating buyers are rebalancing capital into utility-backed fintech tokens.

The presale has already collected more than $700,000, with Stage 2 almost 98% sold out, a demonstration of faith in its roadmap. The price of the token at $0.0159 is going to increase to $0.0194 in the next stage, an increase of 22% that reflects increasing market traction.

Moreover, the $TAP token’s utility is not limited to payment. It fuels the staking program of Digitap ($TAP), with a maximum APR of 124% in presale and 100% post-launch. Its AI-based transaction system also offers obvious financial incentives for the early adopters.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

Digitap Turns Market Fear Into Investor Confidence

Altcoins such as SUI, LINK, and LTC might take some time to recover following the $20 billion liquidation storm. However, unlike with general losses, Digitap ($TAP) is gaining traction among those seeking the best crypto presales 2025. The project is notable for its live omnibank app, high presale demand, and real financial use cases.

The presale price remains low, and estimates suggest there could be a potential 50x spike after launch. Overall, Digitap could shape up to be among the most promising profit plays. Many analysts believe $TAP could potentially be among the top cryptos to invest in 2025.

Digitap is Live NOW. Learn more about their project here:

Presale | Website | Social

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.