Oil Price Shows Glimpses of A Reversal. What’s At Play?

- Oil prices have struggled for momentum this year but there have been signs of recovery this week. We discuss the odds of a reversal.

Oil prices have risen marginally recently, mostly because of concerns about restricted supply, geopolitical tensions, and a drop in U.S. crude stocks. Benchmark WTI was at $64.65 and up by 1.5% while Brent was at $68 and up by 0.3% at the time of writing, moments after the latest US inventory figures came out. The commodity has risen by slightly more than 2% in the last five sessions. This push is a difficult balance because fundamental market conditions still suggest that there could be an oversupply, which would limit any big gains.

Why Oil Price Is Rising

The recent small spike in oil prices doesn’t mean that the market is strong; it’s just a response to a few important developments:

First, the main reason is that U.S. crude oil stocks are declining. Reports from the government and the sector have showed that inventories have dropped more than predicted. In the latest instance, the reading came in at -0.607 million barrels, far lower than the forecast buildup of 800k barrels.

This is commonly seen as an indication of a shortage in supply because it shows that demand is higher than the available inventory, even if just temporarily. This makes the market seem like there is likely to be a near-term scarcity, which could push oil prices further up.

Global conflicts, especially those in important oil-producing regions, add a risk premium to the market. Traders are also being more careful and willing to hike prices because of geopolitical tensions and Western politicians’ intensified rhetoric against Russia. That raises the prospect of future sanctions or supply disruptions more likely.

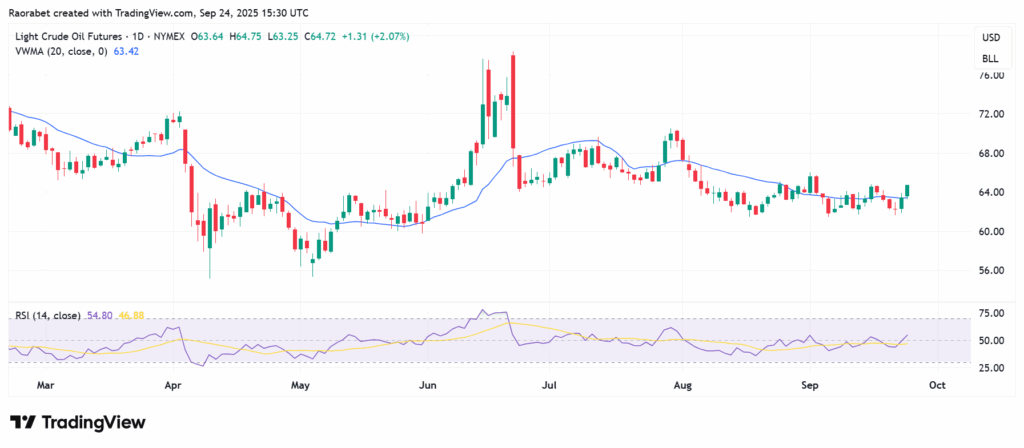

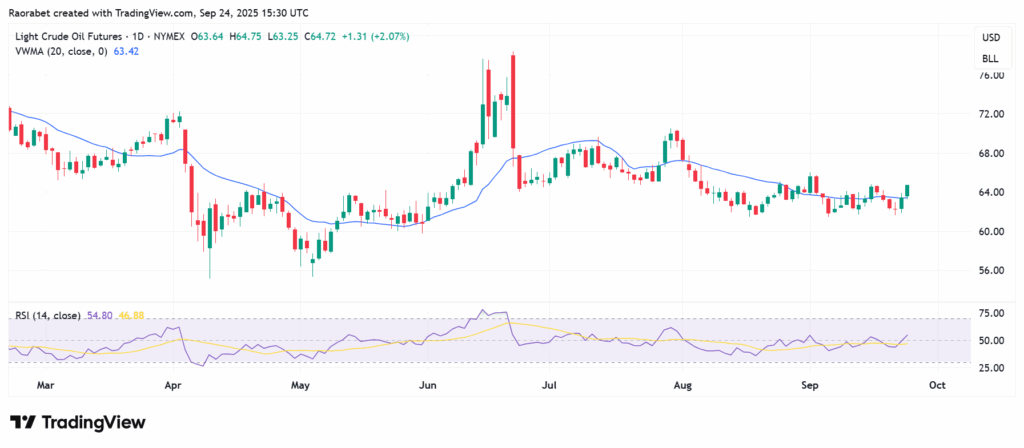

The chart shows RSI on the daily oil price chart is at 54 and the commodity has just crossed above the Volume Weighted Moving Average, signifying bullishness. Source: TradingView

The bigger story is that there might be too much oil on the market, but the oil cartel OPEC+ has been carefully controlling how much they produce. Oil price will be supported by any sign of a slowdown in production or outright production cuts. There has also been a rise in demand, especially in China. Speculation has it that China’s storage capacity expansion and strategic buying are putting upward pressure. However slower-than-expected economic growth could limit this effect.

What Oil Price Needs For Upside Momentum

There are a few things that need to happen for oil prices to really start to rise. Second, there needs to be more demand for oil around the world. If the economy picks up speed. This might happen if Asia, especially China and India, gather stronger growth momentum or if U.S. industrial activity picks up again.

Finally, beneficial macroeconomic conditions could be a factor. If the Fed cuts rates further, it could make the U.S. dollar weaker, which would make oil cheaper for international buyers and increase demand.

In Conclusion

In conclusion, the current rise in oil prices is more due to short-term market conditions and geopolitical tensions than a change in the fundamental supply-demand balance. These factors can give oil prices a short-term boost, but for it to be sustainable, the global economy needs to get stronger. Also, things like unexpected supply disruption, could help the commodity stay on the uptrend. In the absence of these, prices can stay in a range.

Oil price has propulsion from lingering geopolitical tensions, declining US inventories, OPEC+ cuts, and China’s demand recovery.

Weak global demand, U.S. oversupply, and recession fears could limit oil’s gains.

For oil price to build traction that keeps it on the upside, it needs stronger global economic growth to boost demand, decisive supply shocks, or deeper production cuts from OPEC+.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.