Bitcoin Price Up 4% As Saylor Says BTC Investment Cycle Is Fast

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price surged 4% in the past 24 hours to trade at $110,959 as of 3:49 a.m. EST on trading volume that skyrocketed 120% to $60.1 billion.

That rise in the BTC price comes as Michael Saylor says that Bitcoin treasury companies like Strategy can convert $100 million into BTC almost instantaneously. He also recently hinted at another Strategy Bitcoin buy.

The most important orange dot is always the next. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

In an interview on the Market Disrupters podcast on Saturday, Saylor said that Bitcoin’s investment cycle is a thousand times faster than that of technology, real estate, oil, gas, or “anything else you’ve ever seen before in your life.”

Strategy is the largest corporate BTC holder, with 640,250 coins on its balance sheet. Its holdings in the crypto now accounts for nearly 2.5% of the BTC’s total supply.

Saylor’s remarks and his hint of another Strategy buy come as Bitcoin managed to rise back above $110,000 earlier today. This rise coincided with a broader crypto market rebound as traders seem to be regaining confidence amid rate cut hopes.

With the US-China tariff war still a risk, can the price of BTC continue soaring, or will it retrace back?

Bitcoin Price Eyes New Highs As Uptrend Remains Intact

The BTC price continues to show resilience after a brief pullback from the $120,000 area, maintaining its long-term bullish trajectory.

Following a successful rebound near the $100,000 support zone, the Bitcoin price now trades around $110,959, signaling renewed bullish interest within a well-established uptrend.

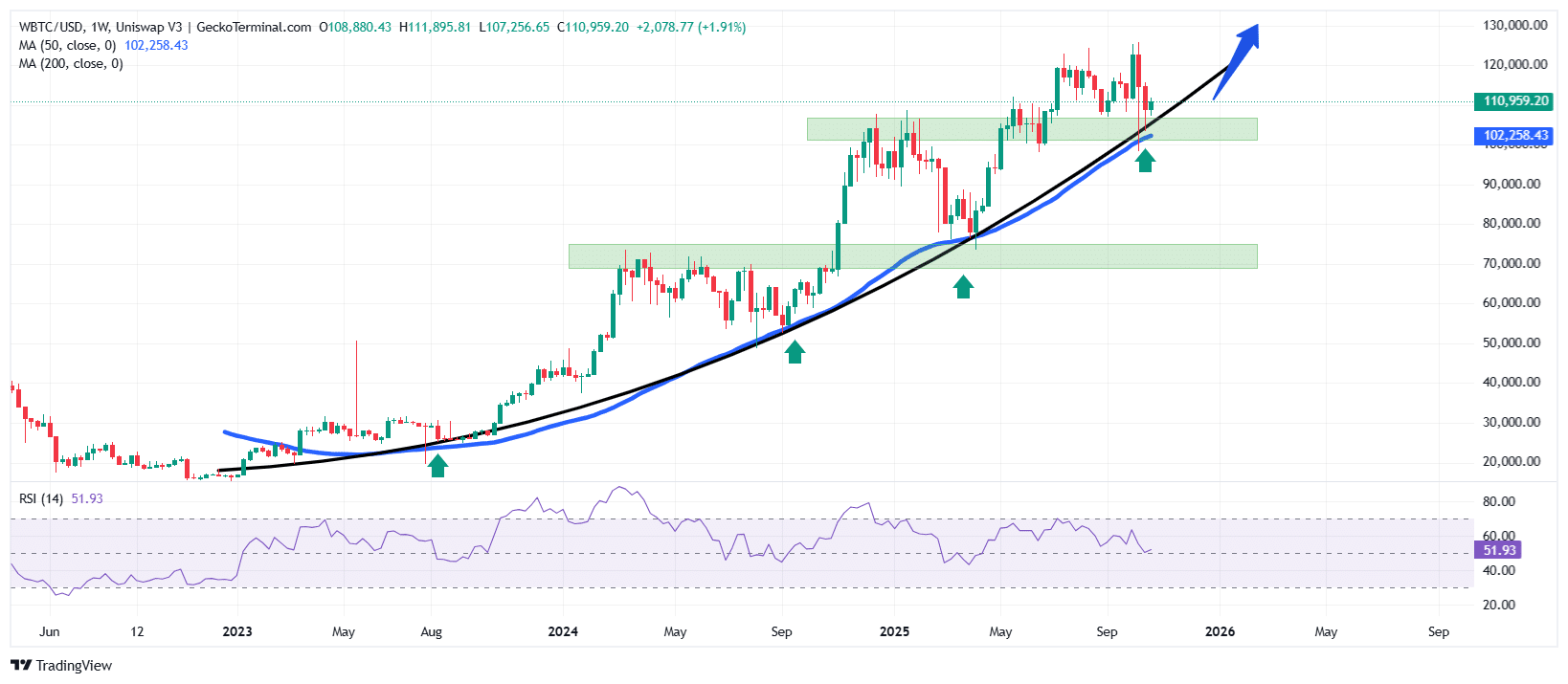

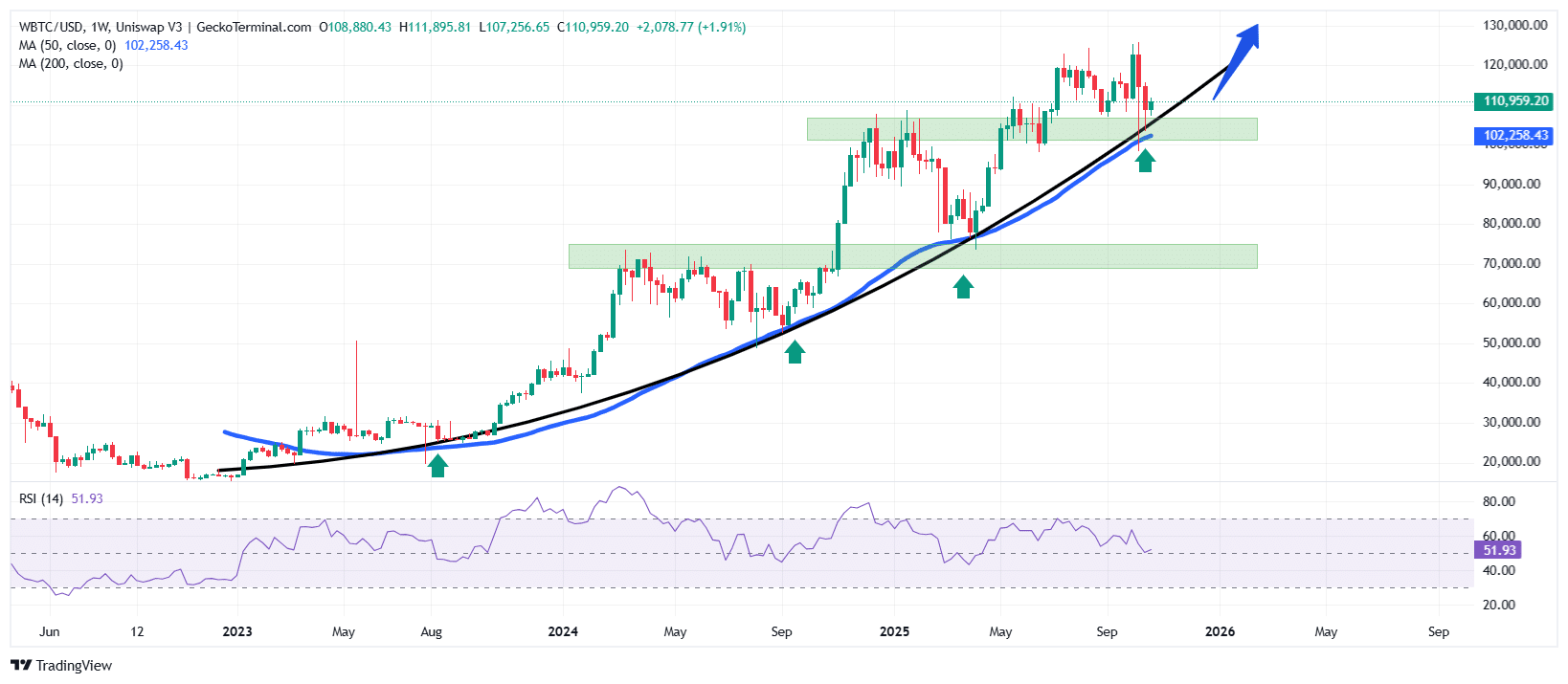

On the weekly timeframe, the price of BTC has been respecting its parabolic curve since mid-2023, with multiple rebounds (indicated by green arrows) confirming strong market demand on dips. Each retest of this sustained support has produced higher lows, showcasing the market’s consistent bullish structure.

Currently, the 50 Simple Moving Average (SMA) on the weekly chart is at $102,258 and trending upward, while the price of Bitcoin remains well above it. This positioning of the asset’s price reinforces the ongoing bullish momentum, indicating that medium- and long-term investors continue to favor accumulation over distribution.

Additionally, key horizontal demand zones around $70,000–$75,000 and $95,000–$100,000 have played crucial roles in stabilizing the price during recent corrections. The most recent bounce from this upper support area suggests that buyers are defending it aggressively, keeping the overall structure intact.

Weekly chart for WBTC/USD (Source: TradingView)

Meanwhile, the Relative Strength Index (RSI) sits around 51.93, which indicates that Bitcoin is going through a period of consolidation within the broader uptrend. This neutral reading suggests that neither buyers nor sellers currently dominate, often a precursor to a strong continuation move.

Bitcoin Price Prediction: $130,000 In Sight As Bulls Exert Pressure

Given the structure of the chart, the overall trend remains bullish, with higher highs and higher lows forming consistently since early 2023. If the Bitcoin price maintains support above $102,000, it could soon attempt to break through resistance near $115,000, opening the path toward $130,000.

Conversely, if selling pressure intensifies and the price of Bitcoin falls below $100,000, the next major support zone lies on the $90,000 level, a prior demand zone.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage