MYX Finance Price Prediction 2025

Story Highlights

- The Live Price Of MYX Is $ 2.94128589

- With innovation in cross-chain derivatives and rising on-chain activity, MYX could reach $26 by 2025 and up to $50 by 2030 if momentum continues.

- MYX surged over 20,000% from June lows to September highs, making it one of the year’s best performers.

MYX Finance (MYX) has emerged as one of 2025’s most remarkable tokens, by delivering parabolic gains in just a matter of months. From trading under $0.05 in June to reaching a new all-time high above $19 in September, MYX has quickly become one of the year’s top performers in the DeFi space.

This meteoric rise has raised the question in the community: Can MYX maintain its momentum, or is the token due for a much deeper correction?

As its decentralized futures exchange is surging in activity by offering advanced cross-chain derivatives trading, MYX is positioning itself as a next-generation platform within decentralized finance. In this article, we’ll explore the fundamentals of MYX Finance, analyze recent market performance, and provide a detailed MYX price prediction 2025 to 2030.

MYX Finance Price Today

| Cryptocurrency | MYX Finance |

| Token | MYX |

| Price | $2.9413 |

| Market Cap | $ 606,214,974.37 |

| 24h Volume | $ 37,477,207.6478 |

| Circulating Supply | 206,105,423.70 |

| Total Supply | 1,000,000,000.00 |

| All-Time High | $ 19.0135 on 11 September 2025 |

| All-Time Low | $ 0.0467 on 19 June 2025 |

What is MYX Finance?

MYX Finance is known as a decentralized futures exchange designed to make derivatives trading more accessible, efficient, and user-friendly to the people who want’s to trade.

Unlike other traditional platforms, MYX incorporates a uniquely brought Chain-Abstracted Wallet that allows traders to move seamlessly across blockchains without manual bridging.

Its simplicity has an innovative two-layer account model that ensures users maintain custody of funds while enabling gasless transactions through a relayer network.

The another highlights that makes MYX more attractive is that this exchange supports leverage of up to 50x with zero slippage, powered by its matching pool mechanism. This enhances efficiency and reduces trading risks.

As a reason why, in September, high-profile token listings happened, such as WLFI. This listing in particular have expanded the platform’s ecosystem and drawn more liquidity into the protocol.

Fundamental Growth and Ecosystem Strength

With the recent October crash, many are thinking MYX is done for, but it’s the exact opposite because the price action might not be supporting now due to macro factors, but fundamentals have never been better.

As MYX Finance’s explosive growth is firmly rooted in robust on-chain fundamentals, moving beyond mere speculation. The platform has demonstrated consistent and significant expansion in user activity, evidenced by its surging monthly trading volume. This volume more than doubled during the year, climbing from $51 billion in January 2025 to $106.39 billion by the mid of october.

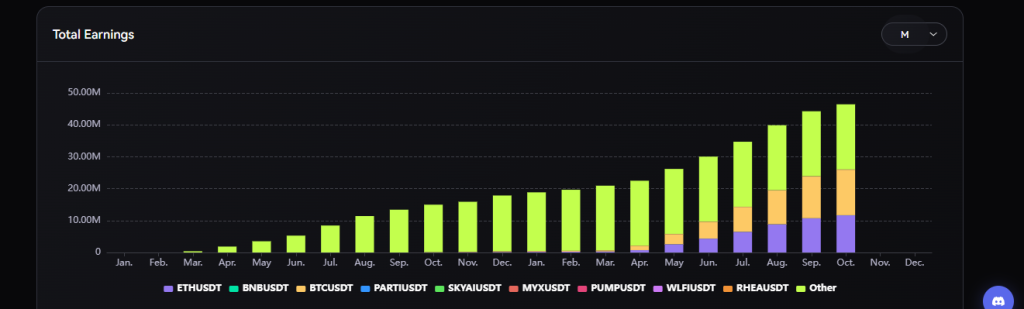

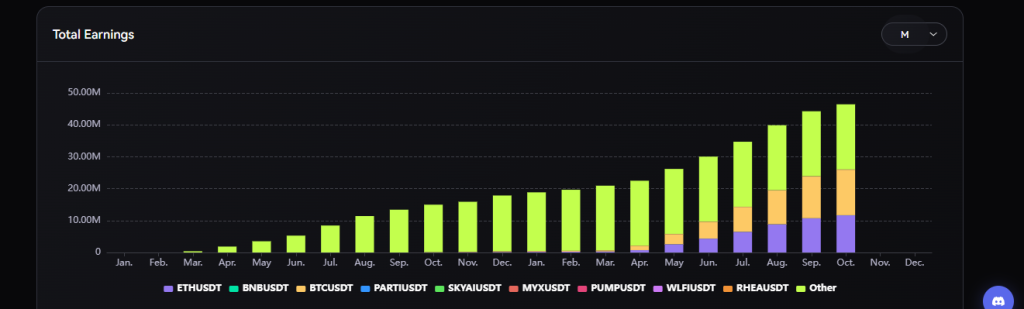

Also, Earnings have more than doubled in the same period, jumping from $18 million to $46.432 million.

Similarly, Total Value Locked (TVL) has seen explosive growth, climbing from $7.4 million at the start of the year to near $58 million by September. This trajectory demonstrates increasing trust and adoption, with new listings playing a significant role in accelerating growth.

If this momentum continues, MYX Finance could regain its lost levels once it regains macro support.

MYX Price Prediction 2025

MYX Finance experienced a truly explosive second half of 2025. Following a multi-month period of consolidation, the token initiated its initial breakout in August, successfully establishing a foothold above the crucial $2 level.

This momentum accelerated dramatically in September, driven by a sector-wide surge across exchange tokens. What followed was a near-parabolic rally that culminated in MYX setting a staggering all-time high (ATH) of $19.90 on September 11th, marking a historic period of price discovery.

However, After the ATH, a sustained period of profit-taking saw MYX consolidate in a broad, yet heavily contested, range between $8 and $19. This period of distribution was violently settled on October 10th-11th when a catastrophic, market-wide liquidation cascade wiped out billions in leveraged long positions.

This brutal shakeout decimated investor accounts and pushed the MYX token back to square one at $1.40. The over 90% decline from the top range effectively served to fill the entirety of the September price action gap, leading many to label the move as a major pump-and-dump cycle.

Despite the seismic volatility, the bulls have since shown remarkable resilience, successfully reclaimed their position near $2.80 to $3 after the crash to $1.40, but then price action underwent a sideways range. This suggests that a renewed demand zone is forming post-shakeout, and this range could serve as a new accumulation point for bulls.

The immediate trajectory for MYX is clear: a sustained push higher through the remainder of November will see the token retest the key resistance pivot at $9, but before that $ the 4.40 and $6.40 hurdles need to be clear first. With a sustained momentum, if MYX price flips that level, it would unlock a clear path toward revisiting the prior ATH zone of $19 by year-end.

Conversely, a failure to hold current demand will inevitably push MYX back toward lower support structures, requiring a full re-evaluation of its market structure.

MYX November Analysis

October began with profit selling but a catastrophic, market-wide liquidation cascade (Oct 10-11) crashed MYX from $17 to a low of $1.40.

The token has since shown resilience, reclaiming the $3 level, which indicates the formation of a renewed demand zone post-shakeout.

The immediate target for the rest of the month is to retest $9 resistance; failure to hold current demand risks a retreat to lower support structures

MYX Finance (MYX) Price Prediction Table (2025-2030)

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $9.00 | $15.00 | $26.00 |

| 2026 | $10.50 | $18.00 | $30.00 |

| 2027 | $12.00 | $24.50 | $37.00 |

| 2028 | $15.50 | $29.00 | $42.00 |

| 2029 | $19.00 | $35.00 | $46.00 |

| 2030 | $21.00 | $38.00 | $50.00 |

Looking beyond 2025, MYX Finance’s future will largely depend on whether it can sustain user growth, expand its ecosystem, and maintain competitive advantages in DeFi trading. As long as the platform continues to capture trading volume and revenues, MYX is well positioned to grow steadily.

By 2026, MYX could stabilize within the $18-$30 range. In the following years, increasing institutional adoption of decentralized derivatives could push MYX toward higher valuations, potentially reaching $50 by 2030.

This table provides a framework for understanding the potential MYX price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

MYX Finance is a decentralized futures exchange that allows traders to use up to 50x leverage with zero slippage. Its unique “Chain-Abstracted Wallet” feature simplifies cross-chain trading.

MYX has shown explosive growth, but its high volatility and concentrated token distribution suggest potential risks. Investors should consider their risk tolerance and conduct their own research.

Based on market momentum and increasing adoption, MYX is projected to reach an average price of $15.00 in 2025, with a potential maximum of $26.00.

MYX Finance is projected to reach a maximum price of $50 by 2030, with an average price of around $38. The long-term forecast depends on sustained growth, broader adoption of decentralized derivatives, and the platform’s ability to remain competitive.

Current sentiment for MYX Finance is mixed to bearish, following a significant price correction after its parabolic rise. While some technical indicators suggest a neutral or even bullish outlook in the short term, concerns about token unlocks, whale activity, and high volatility contribute to a cautious market sentiment.

Investing in MYX Finance in 2025 is a high-risk, high-reward proposition. While its innovative platform and potential for continued growth are attractive, the token’s recent extreme volatility, risks from large token unlocks, and allegations of market manipulation warrant caution. It’s crucial for potential investors to conduct their own thorough research and consider their risk tolerance.