Indian Rupee slides further against US Dollar despite Fed dovish bets

The Indian Rupee (INR) extends its downside against the US Dollar (USD) at open on Tuesday. The USD/INR jumps to near 88.60 as the Indian Rupee underperforms due to a recovery move in the Oil price seen in the past week.

On the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) Crude Oil holds onto weekly gains around $61.50. The crude oil price has rallied lately as the European Union (EU) approved its 19th sanctions package against Russia, and the United States (US) imposed Ukraine-related sanctions on Russia’s two largest publicly traded oil firms, Reuters reported.

Currencies from economies, such as India, that rely heavily on imports of crude oil to address their energy needs, face significant pressure due to higher oil prices.

Additionally, subdued trading activity by overseas investors in the Indian stock market over the past few weeks has also weighed on the Indian currency. The average amount of sales/purchases carried by Foreign Institutional Investors (FIIs) in Indian equity markets has been relatively lower than what has been seen in the past few months.

Going forward, the major trigger for the Indian Rupee will be developments in trade talks between the US and India. Over the weekend, a Bloomberg report showed that negotiators from both nations have agreed on almost all issues, and a deal could be announced soon. The Indian Rupee has been through a rough phase due to trade frictions between the US and China, which followed after Washington increased tariffs on imports from New Delhi to 50% for buying oil from Russia.

Meanwhile, a report from Reuters has shown that the Reserve Bank of India (RBI) has likely sold US Dollars to shore up the Indian Rupee. The RBI has been seen intervening in currency markets a number of times in the past few months to support the Indian Rupee.

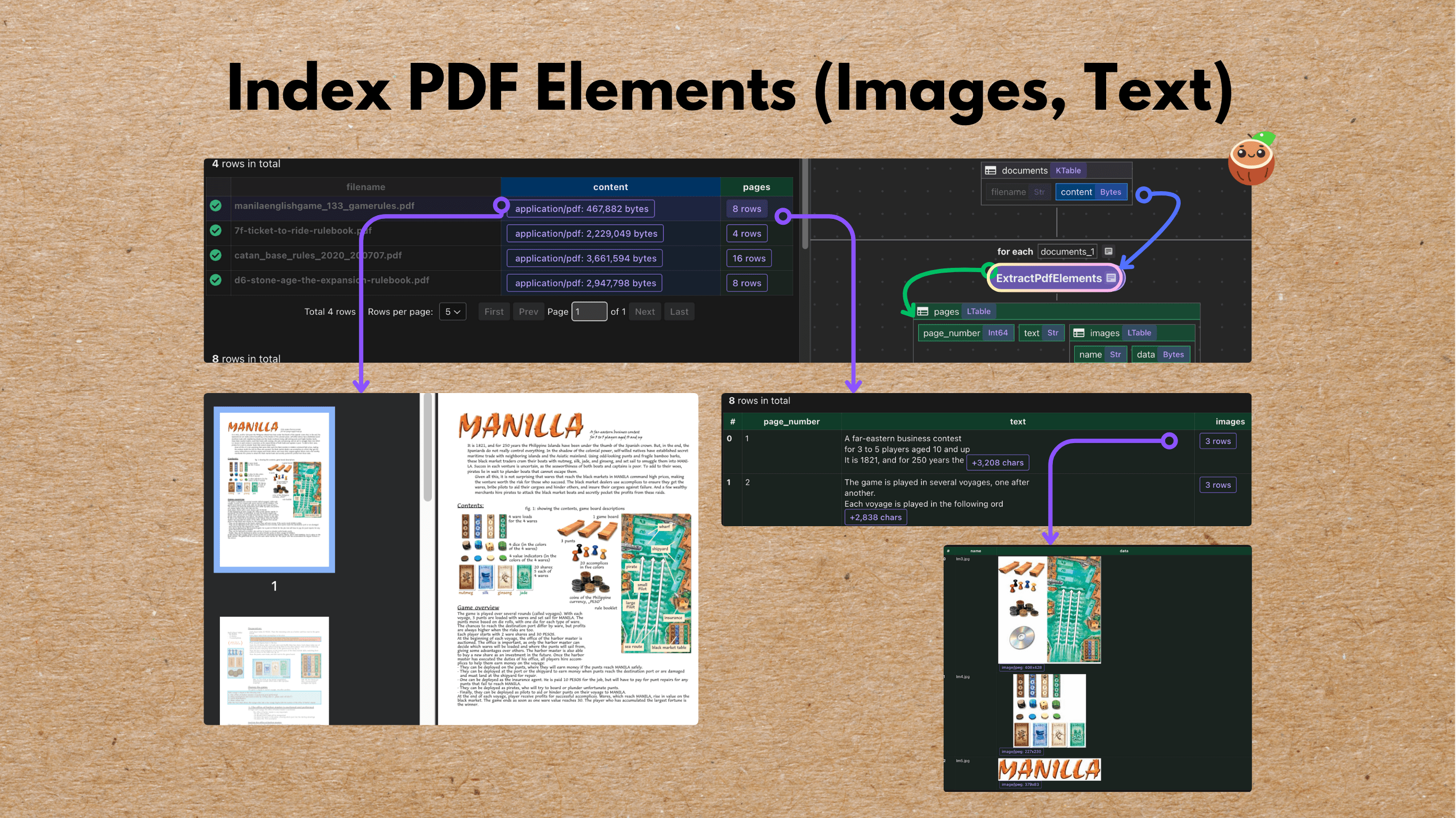

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.20% | -0.64% | 0.00% | -0.02% | 0.11% | -0.24% | |

| EUR | 0.16% | -0.04% | -0.48% | 0.16% | 0.15% | 0.27% | -0.08% | |

| GBP | 0.20% | 0.04% | -0.43% | 0.20% | 0.19% | 0.31% | -0.05% | |

| JPY | 0.64% | 0.48% | 0.43% | 0.64% | 0.63% | 0.76% | 0.39% | |

| CAD | -0.00% | -0.16% | -0.20% | -0.64% | -0.02% | 0.11% | -0.25% | |

| AUD | 0.02% | -0.15% | -0.19% | -0.63% | 0.02% | 0.12% | -0.22% | |

| INR | -0.11% | -0.27% | -0.31% | -0.76% | -0.11% | -0.12% | -0.34% | |

| CHF | 0.24% | 0.08% | 0.05% | -0.39% | 0.25% | 0.22% | 0.34% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily digest market movers: Fed dovish expectations weigh on US Dollar

- The USD/INR gains further on Tuesday, even as the US Dollar revisits the weekly low due to firm expectations that the Federal Reserve (Fed) will cut interest rates in the monetary policy announcement on Wednesday.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.15% lower to near 98.60.

- Traders are increasingly confident that the Fed will cut interest rates by 25 basis points (bps) to 3.75%-4.00% on Wednesday due to labor market risks and moderate inflation growth. Lately, the majority of Federal Open Market Committee (FOMC) members, including Chairman Jerome Powell, have warned of deteriorating job conditions.

- Meanwhile, the US Consumer Price Index (CPI) report for September showed on Friday that monthly headline and core inflation rose at a moderate pace of 0.3% and 0.2%, respectively. So far, the impact of US tariffs has not appeared to be persistent on prices.

- In the policy meeting, investors will also focus on commentary about the further monetary policy outlook. According to the CME FedWatch tool, traders are confident that the Fed will also cut interest rates in the December policy meeting.

- On the global front, improving hopes of a trade deal between the US and China have boosted the demand for risk-sensitive assets. US President Donald Trump stated on Monday that both nations will reach a deal after his meeting with Chinese leader Xi Jinping later this week in South Korea.

- “I’ve got a lot of respect for President Xi and I think we’re going to come away with a deal,” Trump said, and added, “I’ll be going to China in the earlier part of next year,” Reuters reported.

Technical Analysis: USD/INR rises to near 88.60

The USD/INR pair jumps to near 88.60 on Tuesday. The pair strives to return above the 20-day Exponential Moving Average (EMA), which trades around 88.41.

The 14-day Relative Strength Index (RSI) recovers sharply from 40.00, suggesting buying interest at lower levels.

Looking down, the August 21 low of 87.07 will act as key support for the pair. On the upside, the all-time high of 89.12 will be a key barrier.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.

Next release:

Wed Oct 29, 2025 18:00

Frequency:

Irregular

Consensus:

4%

Previous:

4.25%

Source:

Federal Reserve