How High Can Bittensor (TAO) Price Go in November?

Bittensor price had a strong October. TAO climbed about 40% from the lows near $310 and even pushed above $480 before cooling down again. That move caught attention because it happened while the broader market struggled to hold momentum.

This month also brought several big developments around TAO. A new Staked TAO ETP is going live on the SIX Swiss Exchange, giving institutions regulated access to price upside and staking yield.

Analysts are also watching a key breakout level around $449 that could open the way to a much bigger move. And with TAO’s first halving just weeks away, investors are already positioning ahead of reduced emissions. All of this puts the price in an interesting spot heading into November.

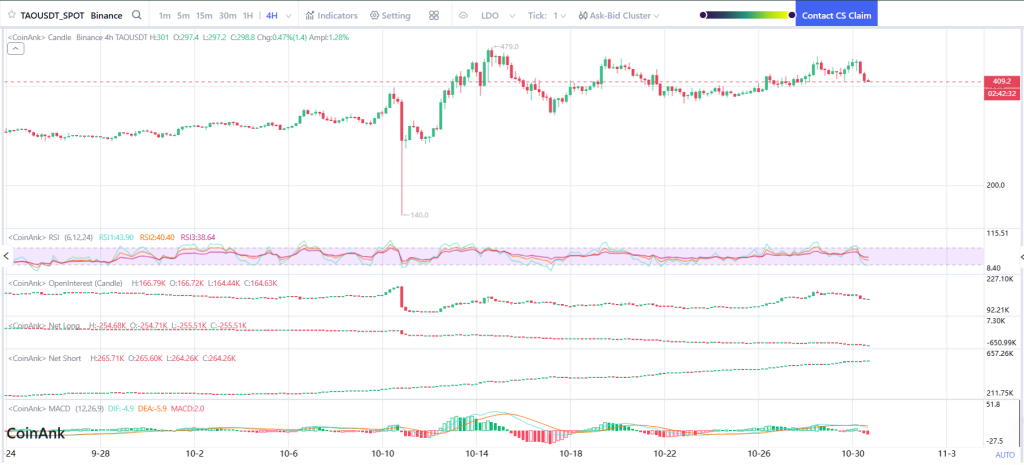

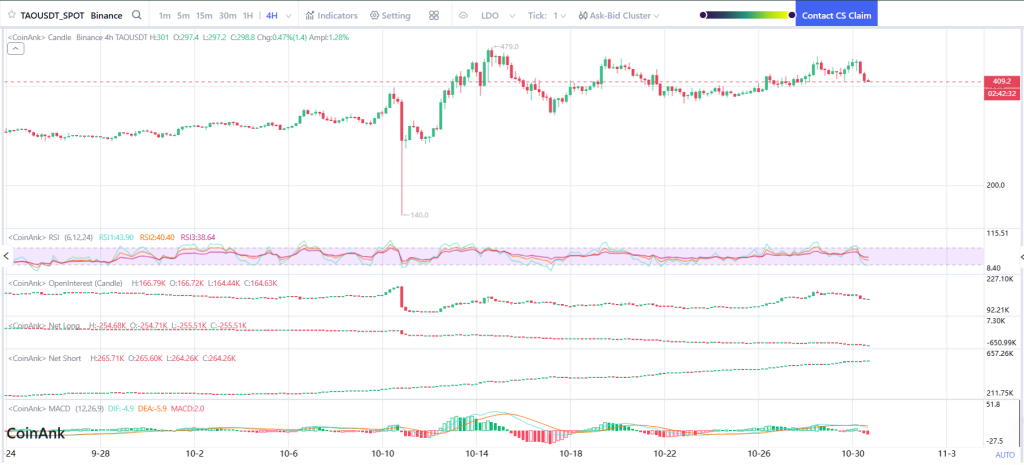

What the Bittensor Chart Is Showing

On the 4-hour chart, TAO price continues to print higher lows since mid-October. That means buyers still show up each time the price dips, keeping the uptrend alive.

The recent rally stalled at around $480–$500, a zone where sellers stepped in aggressively earlier in the month. That level now sits as the major resistance zone that needs to break to continue the move.

The chart shows TAO price consolidating just under that ceiling, which is often how a breakout pattern develops when momentum is still on the bull side. There’s no sign of a trend breakdown right now, as long as price continues holding above $410.

Market Indicators

The RSI reset from short-term overbought territory and sits in a comfortable range now. That means the chart has enough room for another move higher without needing a major correction first.

MACD shows momentum easing but not reversing, with signal lines staying close. Open interest is elevated, which means traders are still betting on future movement rather than exiting the market altogether.

Net long exposure remains stronger than net shorts, showing that confidence hasn’t faded. Support has been holding around the $410–$420 region, and every tap into that zone has seen defense from buyers. That’s the line TAO price needs to keep to avoid sliding back into a wider correction.

Read Also: Here’s the Pump.fun (PUMP) Price if This Breakout Pattern Plays Out

TAO Price Short-Term Outlook for November

November becomes a crucial month because multiple catalysts arrive at the same time. The launch of a staked TAO product gives the asset fresh visibility and easier access for bigger investors.

The technical picture suggests that Bittensor price only needs a small push to reclaim $480, and a confirmed move above that zone could re-target the macro resistance area around $678.

That level was a major turning point last time TAO reached it, and traders will take that as the signal that price is heading into a new breakout stage.

If TAO price fails to stay above $449 and loses momentum at support, then consolidation may stretch longer until demand returns.

Right now the chart shows more strength than weakness. The ecosystem continues to expand, interest from institutions grows, and the halving countdown creates anticipation in the market.

If buyers can reclaim the top of this range with better volume, November could turn into one of the most important months for TAO so far this cycle. The breakout is close; the market just needs to decide whether it’s ready to push it through.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.