Gold’s Crash From All-Time High, Bitcoin Price Recovery To $150,000, And The DeFi Token That Will Replace Silver

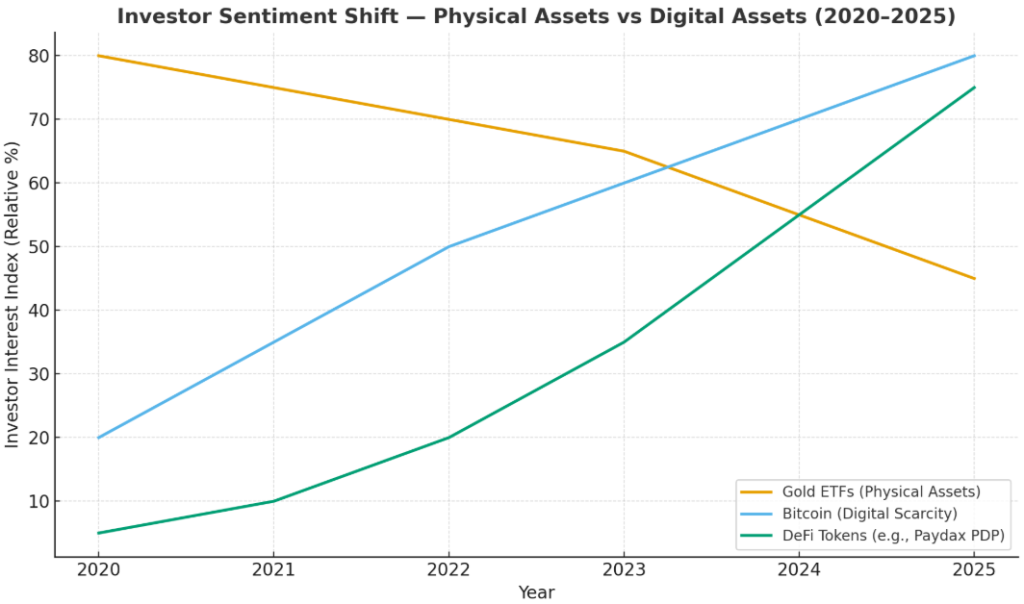

Gold’s sudden reversal from its all-time high has reignited a centuries-old debate about where true value resides. While traditional investors scramble to understand the assets’ steep pullback, the Bitcoin price is quietly mounting a recovery that could redefine modern wealth. Analysts now project the Bitcoin price could surge toward $150,000, fueled by institutional inflows that continue to favor digital scarcity over physical metals.

But amid this changing landscape, a new contender is emerging, threatening to replace Silver in the hierarchy of alternative assets. The DeFi token making waves in this conversation is Paydax Protocol (PDP), a project bridging real-world value with decentralized finance architecture. As Gold falters and the Bitcoin price rises, PDP is positioning itself as the digital era’s liquidity metal.

Why Gold Is Falling While The Bitcoin Price Rallies

For centuries, Gold has been the ultimate safe-haven asset; the hedge against inflation, and anchor of stability when markets tremble. Yet, in 2025, that narrative is showing cracks. After reaching historic highs earlier this year, Gold saw a sharp decline, shedding billions in market value as investors reassessed its relevance in a digital-first economy.

Meanwhile, Bitcoin has reclaimed the spotlight. The Bitcoin price has rebounded with surprising strength, climbing past key resistance levels and attracting fresh inflows. This is a testament to how investor psychology is shifting from physical commodities to DeFi tokens.

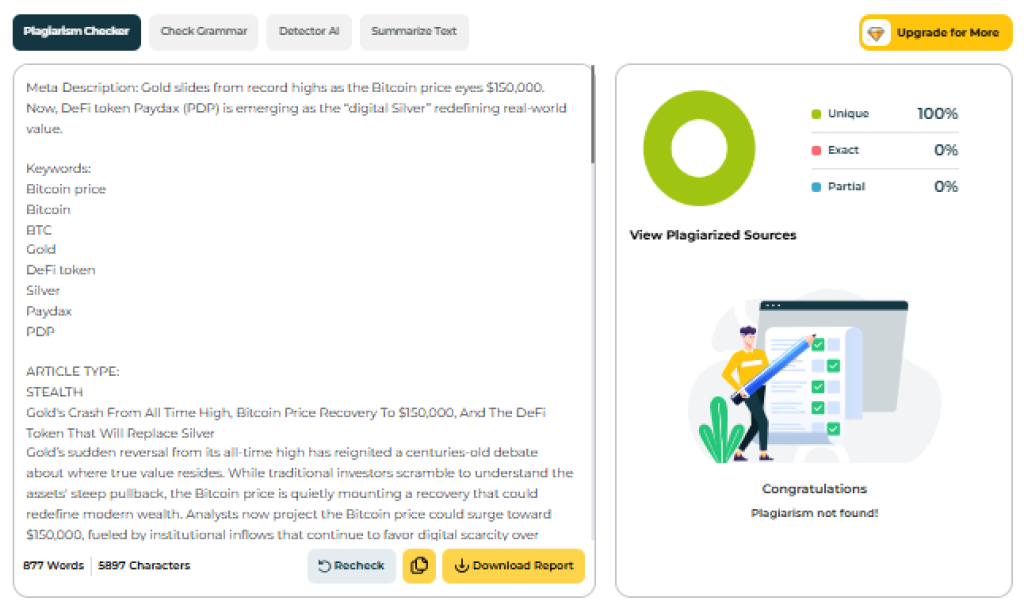

Source: Paydax Protocol

Analysts now argue that Bitcoin (BTC) isn’t just an alternative to Gold; it’s becoming the benchmark for digital resilience. And as the market rebalances, a parallel trend is forming where the Paydax Protocol’s DeFi token, PDP, is taking on the role once reserved for Silver: agile, accessible, and deeply integrated into the financial ecosystem’s infrastructure.

The Asset Shift: From Gold To Bitcoin To Paydax

The divergence between Gold, the Bitcoin price, and Paydax (PDP) tells a story of shifting economic trust. Each asset represents a different era of value. Gold symbolizes legacy wealth, Bitcoin (BTC) embodies digital scarcity, and PDP is emerging as the bridge between real-world liquidity and decentralized innovation.

| ASSET | WHY IT’S MOVING | MARKET SENTIMENT | FUTURE OUTLOOK |

| Gold | Falling from its all-time high due to reduced central bank purchases, a stronger dollar index, and rising U.S. yields. Investors see it as stagnant in a world demanding speed and scalability. | Cautious, declining interest from younger investors. | Likely to remain stable but lose dominance as a generational shift toward digital assets accelerates. |

| Bitcoin (BTC) | Rallying on the back of ETF inflows, institutional adoption, and renewed optimism. Bitcoin price momentum is driven by its proven ability to outperform in inflationary cycles. | Bullish, renewed trust in the Bitcoin price as a hedge against fiat instability. | Expected to cement its position as the benchmark for digital scarcity and monetary independence. |

| Paydax (PDP) | The DeFi token is attracting massive interest as it tokenizes Real-World Assets (RWAs) and bridges tangible value with on-chain liquidity. PDP’s audit by Assure DeFi adds credibility rarely seen in early-stage protocols. | Explosive; investors view PDP as the next evolution of liquidity metals, likening it to “digital Silver.” | Positioned to dominate the altcoin market and redefine utility and yield, replacing Silver. |

In short, Gold is losing ground, Bitcoin (BTC) is maturing into a macro hedge, and Paydax (PDP) is fast becoming the “Silver of DeFi tokens”.

How Paydax (PDP) Is Replacing Silver In The Digital Economy

As the Bitcoin price surges, its upward momentum is rippling across the broader digital economy, and Paydax (PDP) is absorbing much of that capital flow. Investors seeking more than speculative upside are turning to PDP because it offers what Silver can’t.

Unlike most DeFi tokens, Paydax’s fundamentals are driving attention. Holders can borrow against anything, not just BTC, ETH, or stablecoins, but also tokenized luxury assets like watches, art, and collectibles. This frees liquidity without liquidation, creating the kind of flexibility even major crypto lenders and Gold investors can’t match.

Its staking and governance utility adds another layer of strength. PDP isn’t a passive DeFi token. Instead, it fuels compliance, secures the system, and allows holders to shape future upgrades. Through its protection and yield mechanism, stakers can earn up to 20% APY while covering defaults via the redemption pool.

Gold’s Decline Ushers In An Innovative DeFi Token

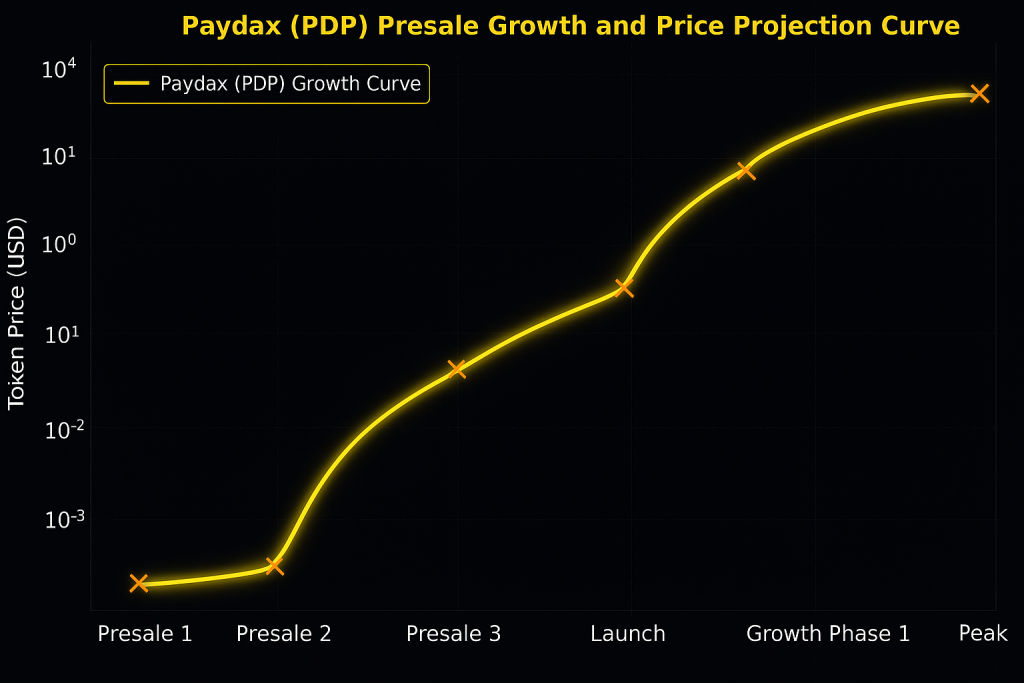

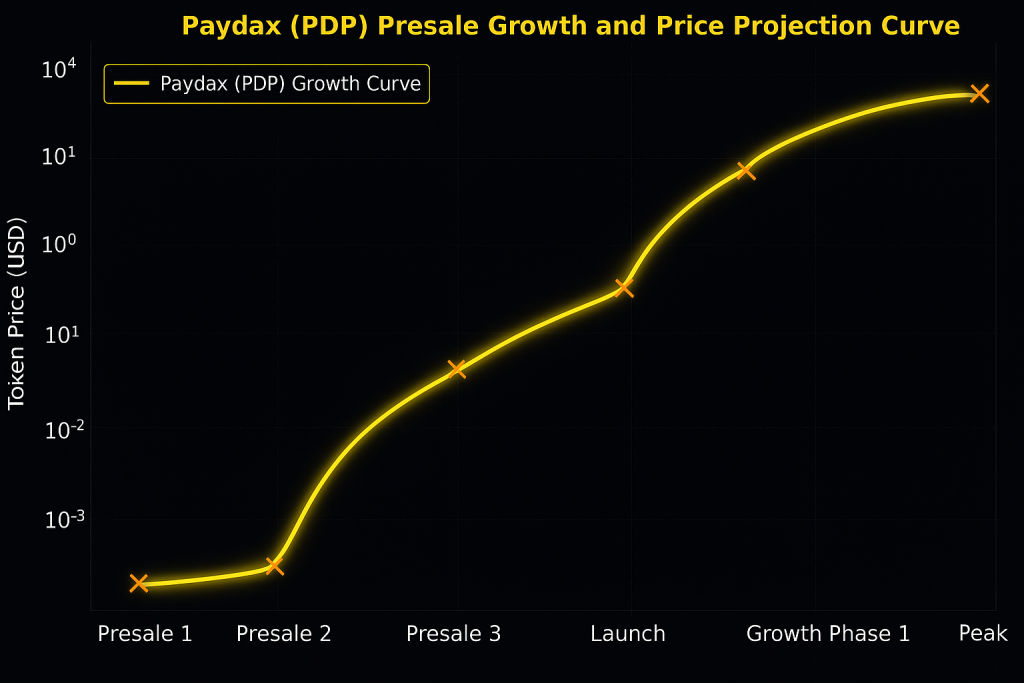

As Gold continues its steep descent from all-time highs, and even with the Bitcoin price climbing, it’s challenging to satisfy the growing appetite for yield and utility. That’s where Paydax (PDP) steps in as the DeFi token redefining what “digital Silver” means in 2025. Each presale milestone inches prices towards new peaks, and early participants are already sitting on expanding margins.

Source: Paydax Protocol

Finally, with Gold and Silver losing ground and digital wealth accelerating, Paydax (PDP) is fast becoming the asset that everyone wishes they had discovered just a little earlier. To enjoy the benefits before it closes, use the PD25BONUS code for a 25% bonus on purchased PDP tokens.

Join The Paydax Protocol (PDP) presale and community:

Website | Telegram | X (Twitter) | Whitepaper

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.