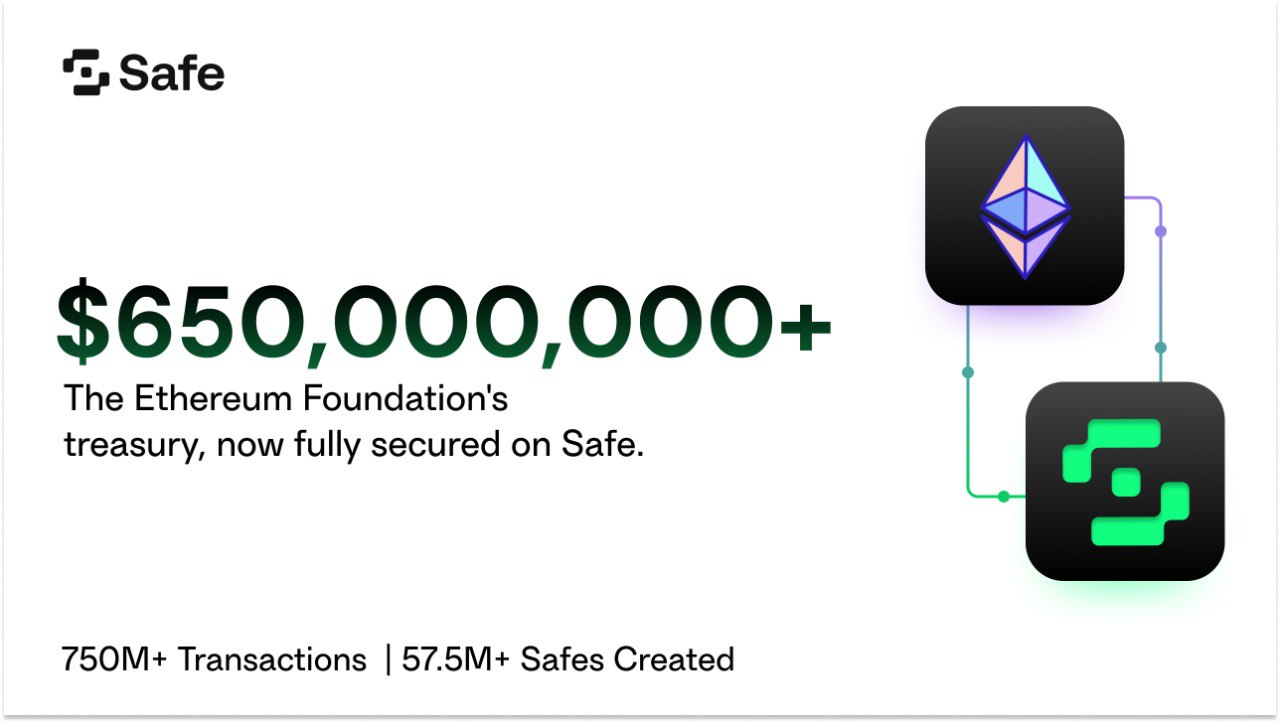

Ethereum Foundation Moves Entire $650M+ Treasury to Safe Multisig

EF completes full treasury migration to Safe smart accounts, joining Vitalik Buterin as key Safe user + Safe smart accounts cross 750M transactions milestone.

The Ethereum Foundation has completed the migration of its full treasury, over 160,000 ETH worth approximately $650 million to Safe{Wallet}, following months of successful DeFi testing. Safe{Wallet}, operated by Safe Labs (a fully owned subsidiary of the Safe Foundation), is the crypto industry’s trusted smart account standard for multisig wallets, securing billions of dollars in assets for institutions, DAOs, and projects.

The move follows the Foundation’s June 2025 treasury policy announcement, which committed to actively participating in Ethereum’s DeFi ecosystem. Since February, the EF had been testing Safe with a separate DeFi-focused account, dogfooding protocols including Aave, Cowswap, and Morpho as part of their strategy to support applications built on Ethereum.

After testing a 3-of-5 multisig configuration on January 20th, the Foundation has now consolidated its remaining ETH holdings into Safe, completing the transition from their previous custom-built multisig solution. This implementation enables the Ethereum Foundation to actively participate in DeFi via Safe while maintaining battle-tested security standards, marking another step toward Safe’s vision of moving the world’s GDP onchain through battle-tested self-custody infrastructure.

“Safe has proven safe and has a great user experience, and we will transfer more of our funds here over time,” the Ethereum Foundation announced, indicating this is the beginning of a deeper commitment to the Safe smart account standard.

Safe’s Momentum

The timing is notable: Safe has just crossed 750 million transactions (751,062,286 as of today) with over 57.5 million Safes created across multiple chains. The protocol has emerged as crypto’s de facto standard for multisig wallets, securing billions in institutional and DAO treasuries. Safe also counts Ethereum co-founder Vitalik Buterin among its prominent users, who revealed in May 2024 that he stores over 90% of his personal crypto holdings in a Safe multisig wallet. Vitalik has used Safe since at least 2024 for personal security, advocating for what he calls “decentralizing your own security.”

Beyond individual users, Safe has attracted major institutional adoption. Trump-backed World Liberty Financial has processed over $3.02 billion in transaction volume through the Safe smart accounts, onchain data shows. Across this period, Liberty’s Safe accounts executed 347 transactions, reflecting consistent institutional use even amid broader market shifts. The figures position Liberty as one of the largest institutional users of Safe’s onchain infrastructure to date.

This growing pattern of major institutions choosing Safe for treasury operations reinforces its position as the leading secure infrastructure layer for digital assets.

Safe’s Milestones:

- Ethereum Foundation: $650M+ treasury secured

- Trump-backed World Liberty Financial has processed over $3 Billion via Safe smart accounts

- Over $65B+ in total assets stored

- 750M transactions executed

- 300+ networks supported

- 200+ ecosystem projects built on the Safe smart account standard

- 57M accounts deployed

Part of Broader “DeFiPunk” Strategy

The migration reflects the EF’s June 2025 treasury policy, which outlined plans to actively deploy treasury assets into “battle-tested, immutable, audited, permissionless protocols” while maintaining a 2.5-year operational buffer. The policy marked a shift from the Foundation’s historically conservative approach, committing to both enhance financial sustainability and support key Ethereum applications.

The treasury policy targets spending approximately 15% of treasury funds annually, gradually reducing to a sustainable 5% baseline over five years, while prioritizing security, open-source principles, and financial sovereignty aligned with what the Foundation calls “Defipunk” values.

The migration marks a powerful alignment: Ethereum’s core steward now uses the same infrastructure it supports, dogfooding the ecosystem it helps build.

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.