BNB Price Prediction – Trump’s Pardon for CZ Sparks New Bull Run for Binance Coin

The crypto market witnessed a shocking twist today as former U.S. President Donald Trump officially pardoned Binance founder Changpeng Zhao (CZ).

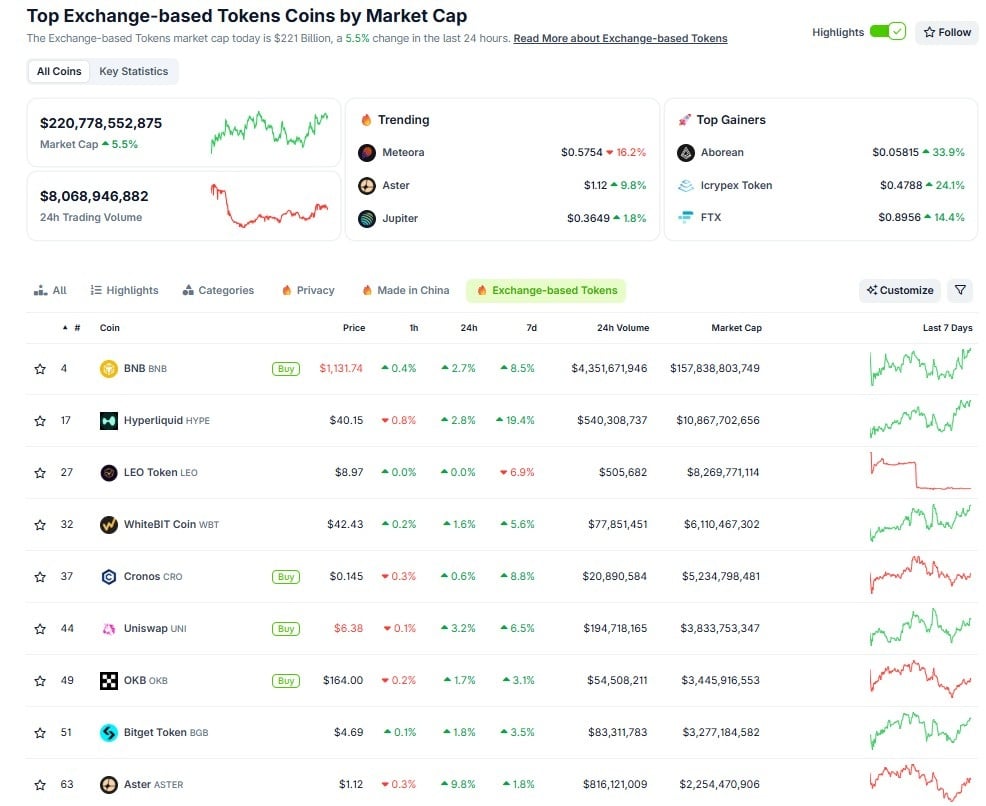

The unexpected development sent BNB soaring over 5%, reaching $1,100 and inching closer to new all-time highs.

Traders are calling this one of the biggest catalysts of the year, sparking optimism of a broader crypto market recovery.

As momentum builds across the market, investors are also turning their attention to Bitcoin Hyper, currently seen as the best crypto presale to buy during this renewed wave of bullish sentiment.

Source – 99Bitcoins YouTube Channel

CZ’s Pardon Sparks Massive Market Reaction

The news of Trump’s pardon effectively removes one of the biggest regulatory overhangs haunting centralized exchanges since 2023. This development triggered an immediate surge in BNB as market participants rushed to price in reduced regulatory pressure on Binance.

Following the announcement, Zhao thanked President Trump for the pardon in a post on X, saying he would back efforts to establish the United States as the global center for digital assets. He also reaffirmed his commitment to promoting Web3 innovation and adoption across the world.

The market impact extends beyond Binance. Other exchange tokens like WBT and OKX could follow BNB’s lead in the coming days, as the move signals a friendlier and less hostile regulatory environment for centralized trading platforms.

The easing of political tension is also expected to cascade into sectors that thrive on regulatory clarity and U.S. compliance.

This may specifically boost confidence in stablecoins and Real-World Asset (RWA) projects such as USDC, ONDO, and POLYX, which are expected to attract renewed institutional interest if the perceived regulatory direction continues to stabilize.

Additionally, major ecosystems like BASE, STX, and various Ethereum Layer-2 networks could benefit, as improved regulatory clarity enables infrastructure-level integrations to expand with less legal uncertainty.

While a presidential pardon doesn’t change existing laws, it has undoubtedly revived market sentiment and reduced fear across the industry. Still, long-term traders caution that such political developments, though impactful in the short term, rarely alter crypto’s fundamental long-term trajectory.

Bitcoin and decentralized finance continue to evolve beyond political influence, regardless of temporary policy shifts.

BNB Price Analysis and Prediction

At press time, BNB is trading around $1,130, up 4% for the day, 12% for the month, and an impressive 92% year-to-date. The coin recently built a strong base around $1,035, signaling robust buying demand.

Analysts believe that surpassing the $1,100 resistance could trigger further bullish momentum and possibly lead to new all-time highs. Market sentiment around Binance has shifted dramatically since the recent pardon.

Traders are once again viewing BNB as a strong contender in the next bull cycle, especially as investor confidence returns to centralized exchanges. This development, combined with improving technical indicators, suggests that BNB could continue its upward trajectory.

Technically, BNB is currently consolidating around $1,130, having rebounded effectively from the immediate support zone near $1,050 to $1,070, which remains a key level to maintain.

Source – Crypto Knight via X

The next major resistance level is the blue line around $1,250 to $1,300, which has acted as a cap on previous rallies. Surpassing this immediately opens the path toward the general target of $1,400 to $1,500.

Furthermore, the red projection line indicates a likely short-term consolidation pattern characterized by small pullbacks and higher lows before a strong upward breakout once the price successfully closes above the $1,300 resistance.

If this major breakout occurs, the chart implies a potential rally toward the $1,700 to $1,800 range, suggesting significant bullish momentum.

In short, the analysis predicts that BNB could surge dramatically higher if it maintains support above $1,070 and successfully breaches the $1,250 to $1,300 resistance zone. The road to $1,500 and beyond is quickly becoming a realistic target in the eyes of many traders.

Bitcoin Hyper Tipped as the Best Crypto Presale to Buy Now

As interest in Layer-2 (L2) solutions continues to rise, one project is standing out in the crypto space, Bitcoin Hyper (HYPER).

While Ethereum and Base have led the L2 conversation, Bitcoin still lacks a fast and scalable solution. Bitcoin Hyper aims to change that by building a powerful Bitcoin Layer-2 network that fixes the issues of slow transactions and limited functionality.

Using the Solana Virtual Machine (SVM), Bitcoin Hyper can handle thousands of transactions per second and support smart contracts, opening the door for advanced DeFi projects, consumer dApps, and new Bitcoin-based innovations.

The network also reports its state to Bitcoin’s main chain through ZK-rollups, giving all transactions the same security and neutrality as those directly processed on Bitcoin’s Layer-1.

These capabilities give Bitcoin Hyper a clear advantage over other blockchains, attracting strong investor and analyst interest. In a recent video, popular analyst Borch Crypto described it as the best crypto presale to buy.

So far, Bitcoin Hyper has raised around $24.6 million in its ongoing presale, and new buyers can still purchase $HYPER tokens at $0.013165 before the next price increase.

Investors can join the presale directly through the official Bitcoin Hyper website using ETH, USDT, USDC, BNB, or even a credit card. $HYPER also serves as a staking asset, letting holders earn rewards through the project’s built-in staking system, which currently offers up to 48% APY.

For a smooth experience, Bitcoin Hyper recommends using Best Wallet, one of the most trusted crypto and Bitcoin wallets available today.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.