BMNR’s Tom Lee Says That The DAT Bubble May Have Already Burst, as Over $1.2B In Leveraged Positions Liquidated in the Crypto Markets

Tom Lee, the well-known strategist from Fundstrat Global Advisors and current chairman of BitMine Immersion Technologies (ticker: BMNR), recently stated that the “bubble” in digital asset treasury (DAT) companies may have already burst.

He made these comments during an appearance on Fortune’s Crypto Playbook podcast amid a broader discussion on the crypto market’s volatility and the rise and potential fall of DATs.

What Are DATs?

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025): registration continues.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

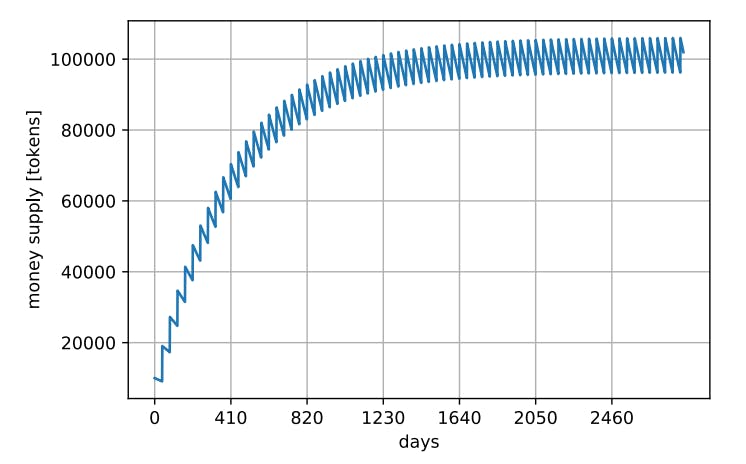

DATs are publicly traded companies designed to give investors indirect exposure to cryptocurrencies by holding large amounts of digital assets like Bitcoin or Ethereum on their balance sheets.

They’re often modeled after Strategy’s Bitcoin-heavy strategy, but applied to various cryptos. The sector exploded in popularity over the past two years as a way for institutions and retail investors to bet on crypto without directly buying coins—especially useful before widespread ETF approvals.

However, with hundreds of DATs now launching, the model has faced scrutiny for creating speculative hype without enough underlying value creation.Lee highlighted that many DATs are now trading below their net asset value (NAV)—meaning their stock prices are lower than the market value of the cryptocurrencies they hold.

He quipped, “If that’s not already a bubble burst, how would that bubble burst?” This reflects thinning liquidity, reduced institutional demand, and a market that’s grown “discerning” about which firms actually add shareholder value beyond just holding crypto.

He warned that simply “holding crypto on a balance sheet doesn’t guarantee long-term performance,” pointing to a $19 billion liquidation event in crypto derivatives earlier that week as a symptom of broader fragility.

Estimates suggest the total DAT market is worth around $162 billion, but 80% of firms are now underwater relative to their holdings. Despite the bearish tone, Lee positioned BMNR which recently completed an $827 million Ethereum buying spree, bringing its holdings to over 3 million ETH worth ~$11.88 billion as an exception.

He described it as more than a “passive DAT”—it’s the world’s largest Ethereum holder, acting as a “liaison between Wall Street and blockchain innovation.” BMNR aims to accumulate 5% of Ethereum’s circulating supply, emphasizing Ethereum’s role in tokenized assets and stablecoins.

Ethereum (ETH) has been under pressure, with recent liquidations wiping out leveraged positions, and broader market fears of a “trade war” under a potential Trump administration adding to the downside.

The hype phase is done. Now it’s builders, believers, and value creators time,” tying it to a potential setup for the next bull run. Skeptics like Raremints questioned if the “biggest ETH bull” (Lee) is turning bearish.

Many DATs trading below NAV signals a market correction, with investors losing confidence in firms merely holding crypto. Weaker DATs may fail or consolidate, favoring stronger players like BMNR with scale and strategic focus.

Reduced hype and liquidity suggest investors should prioritize fundamentals over speculative crypto exposure. Recent liquidations and macro fears like trade war risks could further pressure DAT stocks and crypto prices.

BMNR’s Ethereum focus and proactive strategy may position it to outperform in a maturing market. Lee’s take signals a shakeout in the DAT space—survival of the fittest, where scaled players like BMNR might thrive while smaller ones consolidate or fail.

If you’re invested in BMNR or similar, this could be a moment to reassess NAV discounts versus long-term crypto bets.

Over $1.2B In Leveraged Positions Liquidated in the Crypto Markets

The crypto market is experiencing significant volatility today, October 17, 2025, with over $1.2 billion in leveraged positions liquidated in the past 24 hours alone.

This comes on the heels of a broader sell-off triggered by escalating U.S.-China trade tensions, including President Trump’s announcement of 100% tariffs on Chinese imports, which ignited panic selling earlier in the week.

The total market capitalization has indeed plunged to around $3.75 trillion—levels last seen in early July 2025—wiping out approximately $730 billion in value since the peak last week.

The $1.2B figure primarily affects long positions bets on rising prices, with nearly 79% of liquidations coming from bullish trades. This has hit over 307,000 traders, with standout losses including a $20.4M Ethereum position on Hyperliquid.

This is a continuation of the historic October 10-11 liquidation cascade, which saw a record-breaking $19B some estimates up to $40B in forced closures across the market—the largest single event in crypto history, surpassing the COVID crash $1.2B in 2020, FTX collapse ($3.5B in 2022), and Terra/Luna unwind $8.6B in 2022.

Low liquidity and high leverage amplified the downturn, leading to cascading effects on exchanges. Bitcoin (BTC) has dropped below $106,000, shedding over 5% in the last day, while Ethereum (ETH) and altcoins like Solana (SOL) and Ripple (XRP) saw even steeper declines of 7-10%.

This purge of over-leveraged positions could act as a “healthy reset,” flushing out excessive speculation and potentially stabilizing prices in the medium term—similar to past corrections that preceded recoveries.

However, ongoing geopolitical risks and thinner liquidity in credit markets are heightening caution among investors. Options traders are piling into protective puts on BTC (e.g., at $95K and $115K strikes), signaling bets on further downside.

This cascade wasn’t just a price drop—it exposed deep vulnerabilities in leverage, liquidity, oracles, and stablecoins, turning a geopolitical shock into a systemic purge.

The meltdown unfolded rapidly on a low-liquidity Friday evening into Saturday, amplifying the chaos: October 10, ~4:00 PM U.S. equities close down sharply S&P 500 -2.7%, Nasdaq -3.4% amid broader trade war fears. Crypto, trading 24/7, begins feeling the heat.

President Donald Trump posts on Truth Social about imposing a 100% tariff on all Chinese imports effective November 1, 2025, plus export controls on “critical software.” This escalates U.S.-China tensions, triggered by China’s rare earth mineral export bans, hitting supply chains for chips like NVIDIA and AI/tech sectors.

Bitcoin (BTC) instantly wicks down $3,000. BTC plunges from ~$122,000 to below $110,000 (-10% in hours). Ethereum (ETH) drops 7-12% to ~$3,844. Over $6B-$8B liquidated in the first hour alone, with $3B in the first 60 minutes.

Prices bottom out—BTC at $101,000-$104,782 (-14% to -21% from highs), ETH at $3,373-$3,500 (-18%), Solana (SOL) below $140 (-30%). Altcoins like Dogecoin (DOGE) -50%, Cosmos (ATOM) flash-crash -99% (partial recovery). Total liquidations hit $19B+ by Saturday morning, with $16.7B from long positions (86% longs vs. shorts).

Partial rebound—BTC to $113,000-$114,000, ETH to $3,900+. But fear lingers, with options traders loading protective puts. BTC saw $5.39B in liquidations mostly longs, ETH $4.44B. Altcoins bore the brunt—127K+ traders hit, with meme coins and low-cap assets dropping 50-99% before rebounds.

Tragic reports emerged, including the suicide of Ukrainian crypto influencer Konstantin Galish in a Lamborghini, linked to massive losses. Public firms like Bitmine reported $1.9B floating losses on ETH holdings.

Trump’s tariff announcement ignited trade war fears, strengthening the USD (DXY +2%) and crushing risk assets. Crypto, correlated with tech stocks, got hammered as “collateral damage” from equity deleveraging—no chips without rare earths, no NVIDIA rally, no risk-on vibe.

High leverage up to 100x on perps created a domino effect—margin calls triggered sells, which hit more stops. 99.4% of BTC supply was in profit pre-crash, but short-term holders (STHs) dumped 26K+ BTC.

Weekend thinness + market makers withdrawing to manage inventory starved bids. Exchanges like Binance, Coinbase, and Kraken reported “glitches,” halts, and delays up to 25 minutes, turning a 5-10% dip into a rout. Hyperliquid’s auto-deleveraging (ADL) forced profitable shorts to close, worsening the spiral.

Centralized oracles Chainlink/Pyth fed “faulty” CEX prices (e.g., Binance-dominant), poisoning DEX liquidations. Ethena’s USDe yield-bearing stable depegged to $0.6567 (-34%), exposing multi-asset reserve mismatches under redemption stress.

Suspicious pre-crash activity—whales opened $1.1B in shorts like the $438M BTC at 10x on Hyperliquid hours before the announcement, netting $200M+ profits. On-chain data shows BlackRock-like clusters dumping $970M BTC/ETH “disguised” as rebalancing.

Analysts like Lark Davis called it the “worst ever,” but a “healthy deleveraging” flushing speculation. Leverage ratios dropped sharply, potentially paving for Q4 stability. Options activity spiked on downside protection.

Exposed CEX/oracle centralization risks, stablecoin fragility, and crypto’s macro sensitivity. Regulators may push for better safeguards; meanwhile, inflows to platforms like Kalshi prediction markets surged.

Remnants linger in today’s $1.2B liqs, but this cascade could precede a rebound—historical flushes often yield 20-300% rallies. If you’re in the game, remember: position sizing over predictions.