BlackRock, Microsoft, Nvidia in $40bn Data Center Deal to Secure AI Infrastructure Powerhouse

An investor consortium led by BlackRock, Microsoft, and Nvidia has agreed to acquire U.S.-based Aligned Data Centers in a $40 billion deal, marking one of the largest takeovers yet in the race to secure computing capacity for artificial intelligence.

The transaction, announced Wednesday, underscores how control over data center infrastructure has become a defining battleground in the global AI boom.

The purchase from Australian investment giant Macquarie Asset Management — which has owned a majority stake in Aligned since 2018 — marks the first major deal for the AI Infrastructure Partnership, a global investment vehicle formed last year by BlackRock alongside Abu Dhabi’s sovereign fund MGX, Elon Musk’s xAI, and other heavyweight backers.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025): registration continues.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

“With this investment in Aligned Data Centers, we further our goal of delivering the infrastructure necessary to power the future of AI,” said Larry Fink, BlackRock’s chairman and CEO, who also leads the AI Infrastructure Partnership.

The consortium’s move positions it at the heart of one of the fastest-growing and most capital-intensive arms of the tech industry — the buildout of data centers capable of powering the next generation of artificial intelligence models.

A New Gold Rush for AI Infrastructure

The acquisition comes amid an unprecedented spending spree by Big Tech and Silicon Valley startups, each vying to lock in chips, servers, and power supply for AI workloads.

According to Morgan Stanley, companies including Alphabet, Amazon, Meta, Microsoft, and CoreWeave are projected to spend a record $400 billion in 2025 alone on AI infrastructure — a figure that dwarfs most national capital budgets.

At the center of that frenzy is OpenAI, the San Francisco startup whose ChatGPT model ignited the AI revolution. In recent weeks, OpenAI has reportedly struck long-term supply deals worth over $1 trillion with chipmakers Nvidia, AMD, and Broadcom to secure about 26 gigawatts of computing capacity, enough to power roughly 20 million U.S. homes.

The Aligned deal shows that this infrastructure push now extends far beyond chips — into real estate, energy, and physical computing hubs where AI workloads are processed and stored.

Aligned’s Massive Footprint

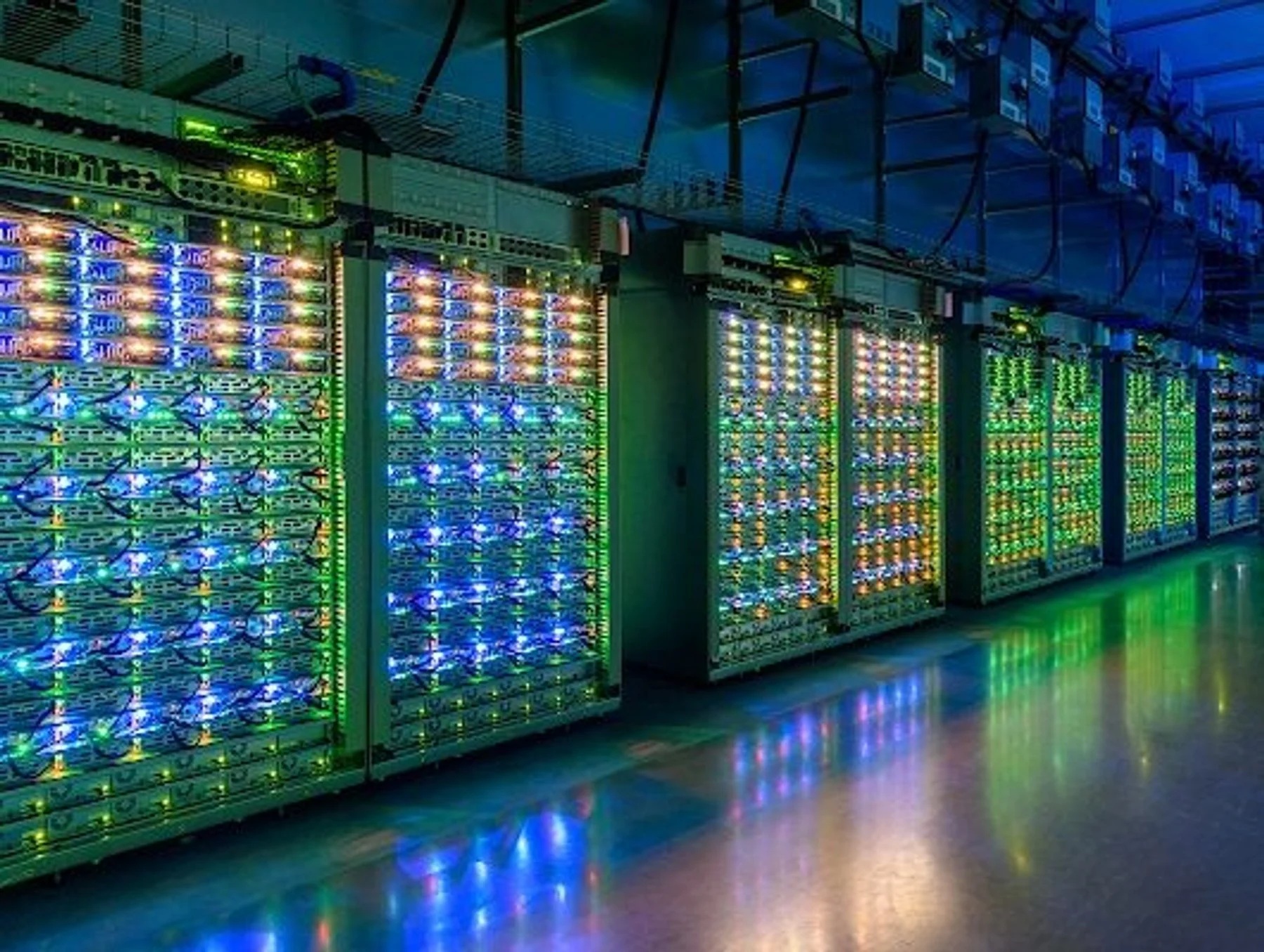

Founded in 2013, Aligned Data Centers has grown rapidly into one of the world’s largest and most efficient operators, boasting nearly 80 facilities and over 5 gigawatts of operational and planned capacity across 50 campuses in the U.S. and Latin America.

Its data centers are known for energy efficiency and modular scalability — two features increasingly prized by AI firms facing soaring electricity costs and space constraints. The company counts cloud platform Nutanix and IT services provider Datto among its customers and owns a land portfolio with significant near-term power access, according to Macquarie.

Aligned is noted as one of the biggest winners of the AI infrastructure boom, having raised $12 billion in equity and debt earlier this year in one of the largest private financing rounds ever for a data center company.

Under the new agreement, Aligned will remain headquartered in Dallas, Texas, led by CEO Andrew Schaap, when the deal closes in the first half of 2026, the investor group said.

Who’s Backing the Deal?

The consortium’s backers read like a who’s who of global capital and technology. Alongside BlackRock, Microsoft, and Nvidia are sovereign wealth funds, the Kuwait Investment Authority and Temasek of Singapore. Together, the group has committed an initial $30 billion in equity, with the potential to scale up to $100 billion, including debt financing.

While the investors did not disclose individual contributions or the equity split for the Aligned acquisition, the sheer scale of their commitment underlines the strategic urgency behind AI infrastructure investment.

Nvidia and Aligned declined to comment, while BlackRock and other investors did not immediately respond to requests for further details.

“All the major parties in that consortium are showing the strength of the AI ecosystem,” said Hendi Susanto, portfolio manager at Gabelli Funds, which holds Nvidia shares.

Rising Value of Data Centers

The deal also reflects how data centers, once viewed as low-margin utilities, have become prized investment assets. Their value has soared amid the surge in demand for AI model training and inference, which require vast computing power and stable, high-energy environments.

Shares of Applied Digital, a publicly traded U.S. data center firm, have jumped more than fourfold this year, and rose another 5% on Wednesday after news of the Aligned takeover. Portfolio manager Joe Tigay of Equity Armor Investments, an Nvidia shareholder, said investors now see these facilities as critical infrastructure assets, not just real estate.

“They’re looking at rapid expansion to meet AI demand and optimize for it,” Tigay said.

For BlackRock — the world’s largest asset manager — the deal represents another step in reshaping its portfolio toward long-term technological and infrastructure bets. For Microsoft and Nvidia, both central players in AI software and chips, the acquisition secures valuable control over the physical layer of AI computing — a hedge against bottlenecks in power supply and data capacity.

AI Infrastructure Race Accelerates

This investment follows a series of similar megadeals as companies scramble to build the next generation of cloud and AI ecosystems.

Meta Platforms is constructing massive AI data centers, including Prometheus, expected to come online in 2026, and Hyperion, which can scale up to 5 gigawatts — rivaling the output of a small nuclear power plant.

Amazon Web Services has announced plans to invest $15 billion to expand its data center footprint in Japan and Southeast Asia, while Google continues to develop its carbon-neutral data centers across the United States and Europe.

The AI Infrastructure Partnership’s purchase of Aligned positions the group as a global force capable of competing with these tech giants not just in capital, but in physical control over the grid that powers AI.

Analysts say the move could have sweeping implications for the balance of power across the technology landscape. By consolidating data center ownership, Big Tech and major investors can better manage capacity for AI training, ensure security of supply chains, and potentially dictate pricing structures for smaller players seeking access to computing power.

The deal also hints at deepening vertical integration — where companies like Microsoft and Nvidia, once focused on software or hardware, now invest in the entire stack, from semiconductors to energy infrastructure.