Bitcoin Slips Below $105K as Tariff Tensions And Liquidations Trigger Market Panic

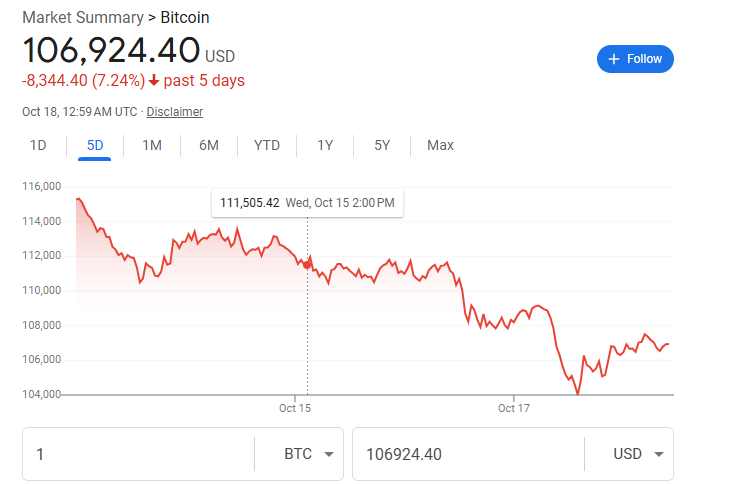

Bitcoin has plunged massively with a recent price slump that has sent shockwaves through the crypto market, as the world’s largest digital asset dipped below $105,000 for the first time since June.

Data from Cointelegraph stated that the decline marked a near 9% drop on the weekly charts following its record high above $126,000.

The downturn reflects waning market momentum amid rising uncertainty and renewed U.S.–China trade tensions. The latest drop mirrors last week fall, when Bitcoin dipped to $104,000 on Friday, after U.S President Donald Trump announced 100% sweeping tariffs on Chinese imports.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025): registration continues.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

Adding to the recent market unease, Trump’s recent speech accusing China of “economic sabotage” has intensified geopolitical tensions. The U.S. president hinted at potential increase to 500% on tariffs should China continue supporting Russia’s energy sector. Treasury Secretary Scott Bessent noted that over 85 U.S. senators back the tariff initiative.

Amid Bitcoin downward price action, the Crypto Fear & Greed Index has now plummeted to 22, indicating a state of “extreme fear” among investors. Massive liquidations further amplified the sell-off. According to CoinGlass, roughly $961 million worth of crypto positions were wiped out within 24 hours, affecting over 260,000 traders globally. Long positions accounted for approximately $749 million of the total, accelerating Bitcoin’s decline below the key $106,000 support level.

Leading cryptocurrency analyst Chris Burniske, noted that last week crypto crash, has severely damaged investor confidence. He predicts that the crypto market may remain broken for some time before a significant recovery starts.

Burniske, who is currently a partner at Placeholder VC, said he is more and more convinced that last Friday’s massacre negatively impacted the crypto market for a while. “It has been difficult to quickly develop a sustained bid due to the sell-off’s extreme violence”, he said, noting that the market’s structural and psychological harm is more extensive than most people realize.

He further noted that this cycle has been disappointing for most investors, not only due to price underperformance in comparison to expectations but also to the waning of the enthusiasm that once propelled speculative growth.

Market sentiment also soured following a sharp drop in U.S. regional banking stocks, reminiscent of the March 2023 mini banking crisis. Then, Bitcoin and altcoins experienced a similar flash crash before staging a swift recovery. “In March 2023, regional bank stocks collapsed, the crisis was ‘contained,’ but nothing really changed,” observed trading resource The Kobeissi Letter in a recent X post.

Traders now warn that Bitcoin may retest the crucial $100,000 support zone, a level many view as pivotal for maintaining market stability. At present, Bitcoin (BTC) is trading at $103,682, at the time of writing this report. Traders remain divided over whether this pullback signals the start of a deeper correction or a healthy consolidation before the next upward move.

Meanwhile, gold’s surge to a new record high of $4,200 has drawn attention and capital away from Bitcoin’s “digital gold” narrative. Gold advocate Peter Schiff, chairman and chief economist of Europac, renewed his criticism of Bitcoin, predicting that gold could reach $1 million per ounce before Bitcoin achieves similar valuation milestones.

“It’s not just a de-dollarization trade but a de-bitcoinization trade. Bitcoin has failed the test as a viable alternative to the U.S. dollar or digital gold,” he wrote on X.

For now, fear dominates the crypto landscape as traders brace for further volatility. Should Bitcoin breach last week’s low of $104,396, analysts warn the market could face another wave of selling pressure on the path toward the $100,000 threshold.

Future Outlook

Currently, market analysts are watching the $107,000–$110,000 range as a key short-term demand zone. A break below could open the door to $100,000, while recovery above $115,000–$123,000 may help restore bullish momentum.