Bitcoin Price Dips As S&P Strategy Junk Rating Called ‘Hilarious’

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price edged down 1.5% in the past 24 hours to trade at $113,980 as of 3:48 a.m. EST on trading volume that dropped 7% to $54.8 billion.

The fall came as S&P Global Ratings slapped a junk rating on Michael Saylor’s Bitcoin treasury firm Strategy because of its ”speculative” exposure to BTC.

The B- credit rating placed the firm six notches below investment grade.

“We view Strategy’s high bitcoin concentration, narrow business focus, weak risk-adjusted capitalization, and low U.S. dollar liquidity as weaknesses,” the agency said.

But the rating marks the first time a Bitcoin-focused treasury company has received an official S&P rating, a significant milestone for the crypto industry’s growing overlap with traditional finance.

S&P Rating ‘Hilarious’

Some analysts took issue with the rating. Adam Livingston, an analyst with 56k followers on X, called it “hilarious.”

Everybody, please read this as it relates to Strategy’s credit rating.

It’s hilarious

S&P Global: “we are likely to continue to view capital as a weakness, because Strategy’s bitcoin holdings are likely to grow materially”

So basically “the more Bitcoin they buy, the weaker… pic.twitter.com/vC4khB4sog

— Adam Livingston (@AdamBLiv) October 27, 2025

VanEck’s Matthew Sigel said the B- rating places Strategy in high-yield territory, implying about a 15% default risk over five years.

🚨Strategy Inc Assigned ‘B-‘ Issuer Credit Rating; Outlook Stable at S&P

That’s high-yield territory. Able to service debt for now, but vulnerable to shocks.

S&P data: B issuers carry ~15% 5-yr default risk. https://t.co/ingZu6DRmH pic.twitter.com/RrHOWYmzVG

— matthew sigel, recovering CFA (@matthew_sigel) October 27, 2025

Despite the agency’s rating, Strategy’s stock (MSTR) rose almost 2.3% yesterday to trade at $295.63.

Meanwhile, Strategy added another 390 BTC to its hoard at a cost of about $43.4 million on Monday. The firm now holds 640,808 BTC.

Bitcoin Price Rebounds Above Key Resistance Levels Amid Bullish Recovery

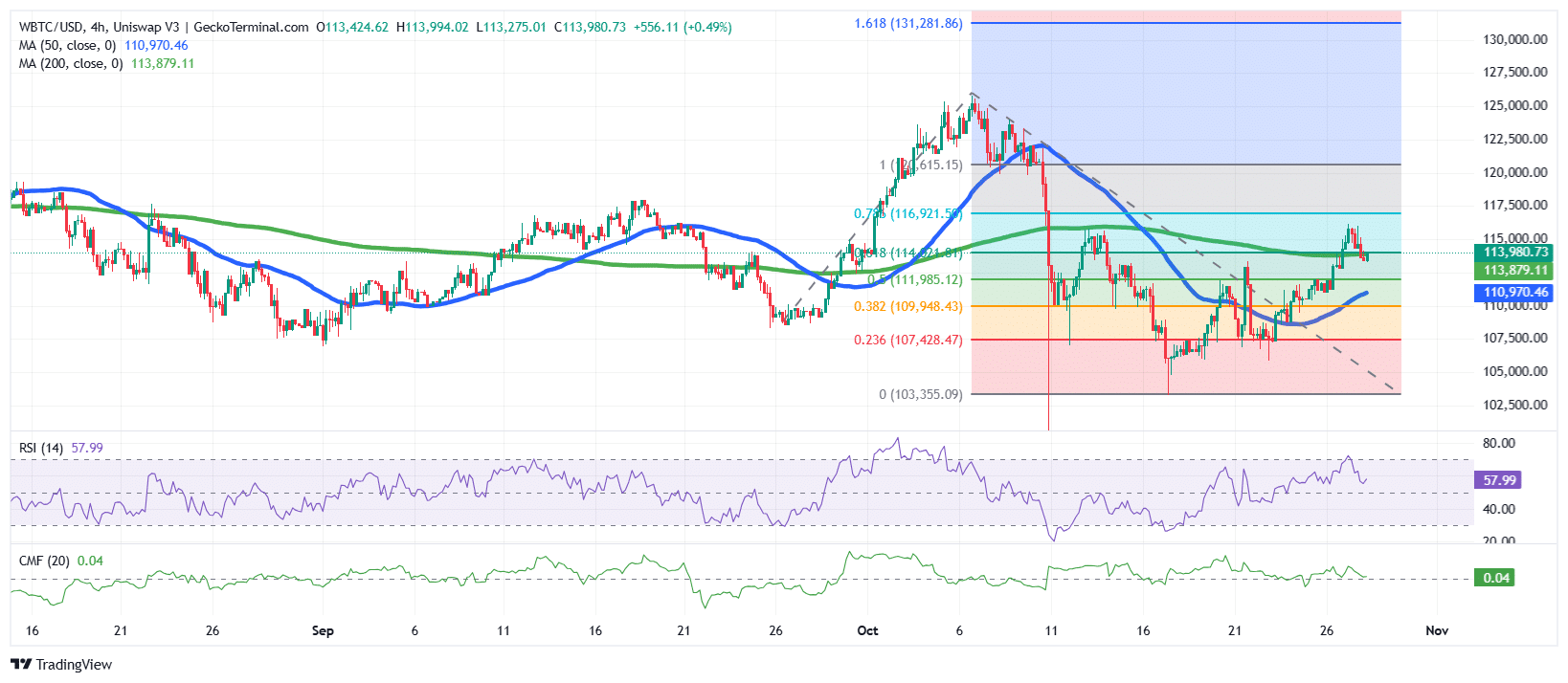

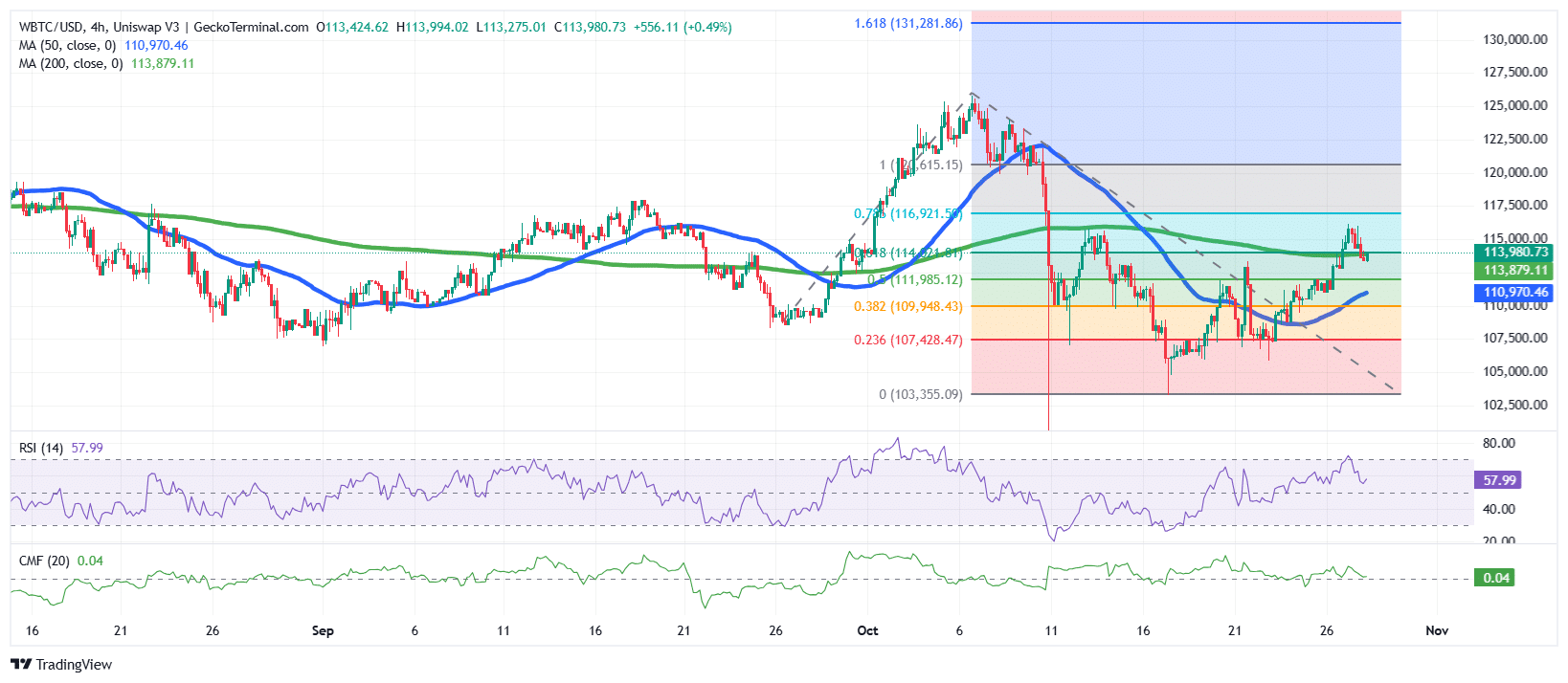

The BTC price has staged a strong rebound over the past week, indicating that the bulls are again gaining momentum after a period of consolidation and correction earlier in October.

Following the sharp decline from the local high near $118,600, Bitcoin found support around $103,350, signaling the start of a new recovery phase.

Since then, the BTC price has climbed steadily, breaking through several Fibonacci retracement levels.

Currently, Bitcoin is trading around $113,980, having moved above both the 50-day and 200-day Simple Moving Averages (SMAs) on the 4-hour timeframe, a strong signal that buyers are regaining control of the market.

The Relative Strength Index (RSI) is currently above the 50-midline level at 57.99. This reading signals that bullish momentum remains dominant, but with enough room for further upside before approaching overbought conditions.

Additionally, the Chaikin Money Flow (CMF) shows a mildly positive reading of +0.04, which is an indication of steady capital inflow and growing investor confidence. Sustained readings above +0.10 would confirm stronger accumulation.

BTC is testing the 0.618 Fib level ($114,324), which aligns with the 200-day SMA, a historically significant confluence point. A successful breakout above this area could accelerate gains toward the $116,900–$118,600 range.

BTC Price Bulls Eye Prices Above $118,000

Based on the ongoing recovery attempt, the BTC price appears poised to continue toward the upper resistance band, provided it maintains momentum above the 50-day and 200-day SMAs.

If bullish pressure persists, the next key resistance levels lie at $116,900 (0.786 Fib) and $118,600 (recent swing high). A breakout beyond this zone could open the path to the Fibonacci extension target at $131,280, representing a potential 15% upside from current levels.

Ali Martinez, a popular crypto analyst on X, says the price of BTC could still soar as long as it holds a sustained uptrend line.

Bitcoin $BTC: Everything depends on this trendline! pic.twitter.com/n492Yjxi6b

— Ali (@ali_charts) October 28, 2025

Conversely, if the BTC price fails to hold above $111,900 (Fib 0.5), a short-term pullback toward $110,000 or even $107,400 (Fib 0.236) could occur before another upward attempt.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage