Is the Bull Market Over?

The crypto market’s poor weekend performance has snowballed into a disastrous Monday opening.

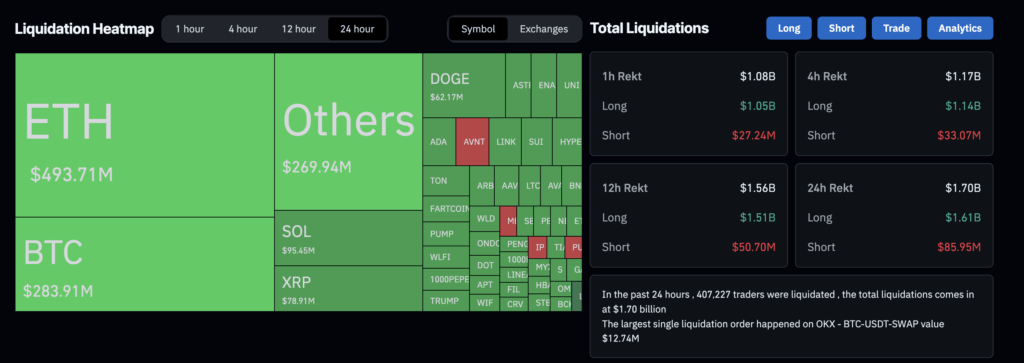

In just one hour, between 2 a.m. and 3 a.m. ET Monday, more than $1 billion in leveraged long positions were liquidated. Data from CoinGlass shows the cascade pushed total liquidations over the past 24 hours to $1.7 billion.

Ethereum is leading the wipeout as its price momentarily dipped to $4,050, down nearly 15% from its September high. Bitcoin fell below $112,000, now down 5% from the month’s high.

Altcoins are facing the brunt of the market crash, with Aster, Pump.fun and Pi among the worst performers. Solana meme coins and Ethereum ecosystem coins are posting steep losses as well, with Fartcoin falling out of the top 100 largest crypto list on CoinMarketCap.

Despite the crypto market crash, experts are confident that the bull market isn’t over.

Why Is Crypto Crashing Today?

Today’s crypto market crash isn’t tied to any single bearish development. Instead, a mix of factors has fueled the sell-off.

Notably, the pullback is being driven by aggressive selling in the derivatives market, with Bitcoin’s spot Cumulative Volume Delta proving negligible compared to the futures CVD.

Structurally, BTC failed to break above the $118,000 resistance and instead confirmed a bearish head-and-shoulders pattern, which played out in today’s decline.

Analysts have also highlighted that last week’s FOMC was a sell-the-news event, and Friday’s Triple Witching has also contributed to today’s bearishness.

Some experts have also taken shots at exchanges and market makers. Prominent crypto analyst Marty has alleged market manipulation by Binance and Wintermute as the key reason behind the market crash.

In fact, Marty is calling today’s pullback the Binance Royal Flush. He is now looking to open leveraged long positions, claiming that the bull market isn’t over.

Is The Bull Market Over?

Despite today’s crypto market crash, experts are confident that the bull market isn’t over.

Global Macro Index’s Head of Macro Research, Julian Bittel, claims that Bitcoin isn’t even close to its cycle top. His institutional-grade tool, GMI’s Bitcoin Cycle Top Finder, is significantly below the levels that have typically indicated the end of a bull market.

Bittel argues that Bitcoin’s typical four-year cycle may run longer this time, as it increasingly trades like a macro asset tied to the broader business cycle.

With interest rates held at elevated levels for an extended period, the next business cycle expansion has yet to properly begin. Now that the Fed has started cutting rates, he anticipates both the business cycle and Bitcoin’s rally to gain momentum in tandem.

This doesn’t mean that crypto prices wouldn’t see more downside volatility heading into the month’s end. Andrew’s Pitchfork shows that BTC could hit $110,000 in the short term, while the MVRV pricing bands reveal that $93,000 could come into play if the $115,000 support isn’t reclaimed.

However, these would only be excellent buy the dip opportunities.

Best Cryptos To Buy Now

Investors are better off avoiding attempts to catch the falling knife amid the prevailing bearish sentiment. Instead, they should wait for a successful retest of key support levels before buying.

On the contrary, buyers should keep an eye out for a potential bullish reversal in Aster (ASTER). This new DEX coin stunned investors with a 1900% rally in just 5 days, surpassing the $3 billion market cap.

While it has pulled back since, there is no reason why ASTER should show a strong correlation with Bitcoin, making it an excellent hedge.

Presale cryptos are also attractive investments during market uncertainty. It is not without reason that whales are pouring six-figure investments into Bitcoin Hyper (HYPER), a new BTC layer-2 coin that has raised nearly $18 million in short order.

One whale purchased over $150k worth of HYPER in a single transaction, data from Etherscan reveals.

Layer-2 coins show a strong correlation with their respective layer-1s. With BTC expected to hit $150,000 this bull cycle, HYPER could be a viable investment for outsized returns. As such, the top L2 projects like Arbitrum, Optimism and Stacks tend to reach multibillion-dollar valuations.

Unsurprisingly, many are calling Bitcoin Hyper one of the next 100x cryptos.

Visit Bitcoin Hyper Presale

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware that our commercial partners may use affiliate programs to generate revenue through the links in this article.